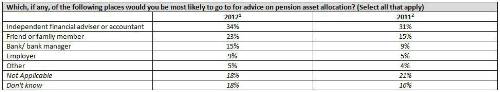

• Nearly a quarter of working people in Britain (23%) select ‘friends and family’ for pensions advice, up from 15% in 2011

• 45% of non-retired Brits said they have never reviewed their financial plans for retirement

• More than a third (35%) opted for the ‘default’ investment option when they reviewed their pension, 41% couldn’t remember

New research1 from Baring Asset Management (Barings), the international investment management firm, has found significantly more people are turning to friends or family for advice on their pensions while the number of people turning to financial advisers remains flat. Nearly one in four non-retired respondents (23%), equivalent to 8.4 million British adults, selected ‘friend or family member’ from a list of preferred advisers on pension assets, up sharply from 15% in the 2011 Barings survey2.

The figures for those aged 18 to 24 are even more acute: well over a third (37%) ask friends or family, far higher than the 25% that turn to a financial adviser or accountant. In the next age segment, those aged 25 to 34, 27% say they ask friends and family, slightly more than 25% who discuss their pension needs with a financial adviser.

Intermediaries remain the most popular source of advice overall: they were selected by a third (34%) of non-retired respondents for advice on pension asset allocation, the equivalent to 12.1 million people. However, this market share has remained flat compared to last year (31%) as well as 20103 (33%) and 20094 (36%), but down from its peak in 20085 (40%). In contrast, the numbers of people turning to their bank is rising, up to 15% versus 9% in 2011.

Despite the changing sources of financial advice, the majority of non-retired British adults (58%) said that they do consider it their responsibility to ensure they fully understand the asset allocation of their pension funds. However, when asked when they last reviewed their pension plans, 45% of non-retired respondents said they had ‘never’ done so, while for those who had reviewed their plans this was, on average, 2.4 years ago. When asked about the last time they had made a change to their pension and investments in order to better reflect their risk profile, 38% of respondents said they had ‘never’ made such a change, while 5% – equivalent to 2.3 million people – said they had done so more than ten years ago. The average answer to this question was 1.7 years ago.

Marino Valensise, Chief Investment Officer at Barings, comments: “Millions of people may be exposed to poor asset allocation and inappropriate levels of risk due to a refusal to review their pension investments regularly and with the correct levels of advice. While it’s good that the majority of people see it as their personal responsibility to monitor and understand their pensions, they need to follow this up and make sure they are speaking with their financial advisers. This is more important than ever given the current volatile economic environment.”

Looking at people who had reviewed their pension plans, an incredible two in five (41% of people) – corresponding to 8.1 million – were unable to say whether they had selected the default option or not for their pension investment. More than a third (35%) – 7 million people – said they opted for the ‘default’ investment option, meaning their pension provider selected funds on their behalf. However, of those that selected the default option, over a third (38%) rated the advice and explanation around the default process as either poor or non-existent.

Marino Valensise continues: “It will be interesting to see how the findings have changed next year in the wake of the Retail Distribution Review, and whether the sources of advice continue to split. During these times of such economic uncertainty it is surprising and somewhat worrying that people seem more inclined to ask friends and family for advice. Understanding pension investments is more important than ever to ensure that it will provide appropriate financial support in retirement. With increased awareness of the on-going financial crisis it is our hope that people become more aware of their pensions and the underlying asset allocation, and that we will see more people properly reviewing and examining their portfolios and making sure they have the optimal asset allocation.”

|