As the cost of living in the UK continues to spiral people are cancelling or switching their insurance policies in a bid to make savings, according to the latest edition of the Cost of Living Consumer Behaviour Tracker published by Consumer Intelligence.

Around 7% of people have already cut back on insurance to make savings in the last three months and a further 7% are considering back in the future. Among those who have already cut back 67% say they have switched some of their policies to cheaper alternatives while 43% have opted to cancel some policies completely.

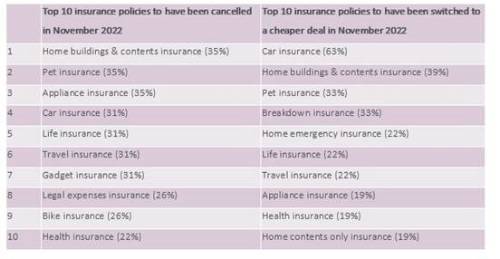

Of those who have cancelled policies, home buildings and contents insurance, pet insurance and appliance insurance are the top three cancelled policies. Of those who have switched to a cheaper deal in November, car insurance was the most popular, with 63% saying they’d switched their car insurance policy.

Consumer Intelligence’s Head of Consumer Strategy, Catherine Carey, commented: ‘We’ve been tracking the cost of living and the impact on consumer behavior over several months, and it’s clear that consumers are looking for as many ways as possible to save money. These latest Viewsbank results show a worrying trend, that in a bid to do as much as they can to save money, a high number of consumers are cancelling insurance policies or switching to a cheaper deal.

“This is extremely concerning, especially when it comes to home buildings insurance, which although it isn’t a legal requirement is generally required by mortgage lenders and should the worst happen could result in enormous financial and personal loss.

“We know the general insurance market is already responding to the FCA’s general pricing practices rules with essential products – their own ‘basic’ ranges. But as an industry we might not be doing enough to be the safety net that newly financially vulnerable customers really need.”

Table to show those who have cancelled their insurance policies or switched to a cheaper deal

Since the cost-of-living crisis began, 5% of people say they have become more likely to make a false or exaggerated insurance claim, compared to 30% of people who say they have become less likely to do so.

Car owners aren’t only switching their insurance in a bid to save money, but one in ten (10%) motorists plan to reduce the number of cars in their household in the next 12 months. More than one in ten (11%) have decided to delay buying a new car in the last three months as a result of the cost-of-living crisis, with 36% of them saying they won’t buy a new one until the cost of living starts to fall.

|