Released today, the Risk of Ruin report considers pension scheme risk from an Integrated Risk Management perspective, testing changes to funding, investment and management strategies against covenant strength by using sophisticated proprietary market- leading software and modelling tools.

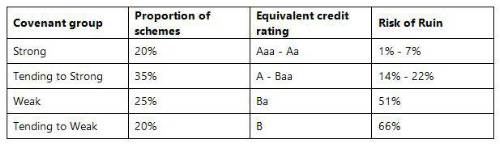

PSTS found that the strength of covenant was key with only one in five UK schemes having a high chance of being able to deliver member benefits in full. For schemes with a sponsor rated as weak – representing around 20 per cent of total UK DB schemes – the “risk of ruin” is estimated to be 66 per cent.

The report also shows that, for the average UK scheme*, the issue of affordability of contributions is also very significant with employers already having to extend their recovery plans beyond the average period of 8 years suffering a significantly higher risk of failure due to their limited inability to deal with adverse deviation.

Richard Jones, Principal at Punter Southall Transaction Services comments: “Since the introduction of the Pension Protection Fund in 2005, more than 10% of defined benefit schemes have failed to deliver their promised benefits in full and around 1% of schemes fail each year. Over the long-term, our projections suggest that around one third of UK schemes will fail to deliver members’ benefits in full.”

The report also explores impacts of steps taken to reduce the “Risk of Ruin”

• Increasing the level of technical provisions held by a scheme whilst reducing risks to member benefits can result in a very high price for sponsoring employers.

• Shorter recovery plans, including paying off deficits by lump sums, have limited impact on the “Risk of Ruin” as they are just a small acceleration of monies the scheme would expect to receive in any event.

• The investment risk within a pension is borne almost entirely by the sponsoring employer such that de-risking the investment strategy does not reduce the “Risk of Ruin”

• Contingent assets can be a very effective method of reducing the “Risk of Ruin” if they are structured correctly

• Trustees should consider being more supportive of liability management exercises proposed by sponsors.

Jones added: “By looking at the combined risks to member benefits presented by covenant, funding and investment decisions in an Integrated Risk Management framework, we can see that some steps favoured by trustees in managing their schemes - such as acceleration of deficit payments and de-risking - may not be significant in reducing the chances of members not receiving their benefits in full.”

“With the increasing focus of the Pensions Regulator on Integrated Risk Management, trustees can use the technology and modelling tools that underpin our “Risk of Ruin” report to consider their strategy in the round, taking account of the impact that covenant, funding approach and investment strategy has on the likely outcomes for their members.”

|