Online searches for ‘state pension’ jumped 124% in March and 83% in April. There were around 110,000 searches in March 2022, compared to 246,000 this year according to new analysis from Standard Life, part of Phoenix Group.

This was likely caused by a combination of a deadline for people to boost their state pension by filling gaps in their National Insurance record through voluntary contributions and people seeking information about the amount they will receive in their pension when the new tax year began.

For those that reached State Pension age after 6 April 2016, there is currently a chance to plug gaps in their NI record going back to 2006 and levels of demand have been so great that the July 2023 deadline has been extended to April 2025.

With the Government honouring the pension triple lock this meant the state pension increased by an inflation-linked 10.1% this tax year. Many pensioners will also have been eager to know how much they’d receive, and this has arguably been one of the big drivers of the spike in internet searches during this period.

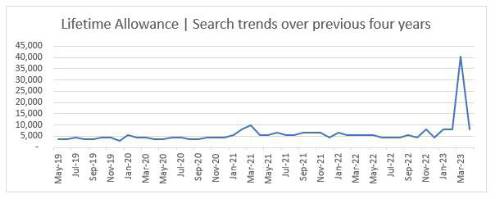

Lifetime allowance bombshell drives searches

Internet searches for the pension lifetime allowance were also up 1,020% in March and 50% in April, compared to the same time last year, as consumers scrambled for information following the bombshell announcement it would be scrapped in the March Budget.

Dean Butler, Managing Director for Retail at Standard Life, comments: ““Everyone is looking to make their money go as far as possible right now so it’s not surprising state pension searches have been so high at a time when many are also trying to establish whether they are eligible for a state pension top up. For those with gaps in their NI record, the government’s scheme could be worth thousands of pounds to them in retirement. A rush of demand for it is reflected in search volumes and just this week the deadline was extended to 2025.

“The bombshell moment in the 2023 Budget when Jeremy Hunt announced the scrapping of the lifetime allowance, drove a huge rise in internet searches in March. Both industry and pension savers alike were taken by surprise by its removal and people have been trying to establish what this means for their pension planning and how likely the removal is to last into the future.”

|