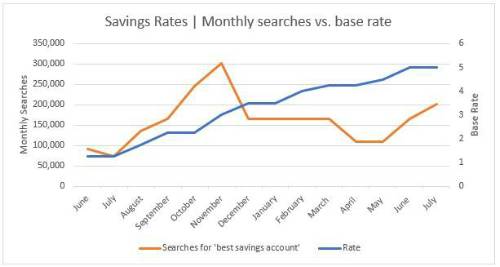

Online searches for ‘best saving account’ jumped 82% in June and 172% in July compared to the same time last year. This equated to around 165,000 searches in June and 201,000 in July as thousands of additional savers went on the hunt for better rates according to new analysis of search engine data from Standard Life, part of Phoenix Group.

Savers search for best buys in second wave of deal hunting

A series of rate increases in the last twelve months also drove over 74,000 searches for ‘best savings rate’ in June and a further 90,500 in July. The recent uptick follows an initial spike in searches linked to savings rates in November last year which followed a period in which interest rates more than doubled between June and November 2022.

The recent search trend was replicated over a variety of terms associated with savers on the hunt for better rates. For example, there were around 18,000 searches for ‘best 1 year fixed rate ISA’ in June which increased to just over 22,000 in July – equivalent to annual increases of 235% and 311% respectively. Not only do those with cash savings have scope to generate higher returns but recent falls in inflation mean the gap between interest rates and inflation is now relatively modest on certain types of savings account.

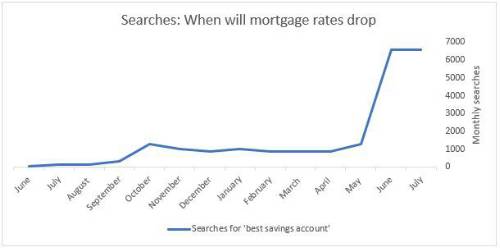

Borrowers hope rates have peaked

There was a corresponding increase in people seeking information on when mortgage rates may fall. Searches for the term ‘when will mortgage rates drop’ jumped from next to nothing twelve months ago to nearly 7,000 in June and July.

Dean Butler, Managing Director for Retail at Standard Life, comments: “Over the last decade returns on cash savings have been meagre. However, eight rate rises in the last twelve months have prompted those with cash to look again at what’s on offer and the search data suggests people are shopping around. There’s a catch however as higher returns have been accompanied by even higher inflation and although the gap between the two is closing, those with excess savings will want to consider investing some of their money through their pension or investment ISA as it offers the potential to generate real returns.

“While it’s good news for savers, the search data paints a different picture for borrowers and there’s evidence that mortgage holders are looking for insight on whether rates have peaked. This is an anxious time for those coming to the end of fixed rate deals many of whom will be weighing up whether to refix their mortgage or hold off to see whether rates come down at all.”

|