People aged between 45 and 70 who have gaps in their NI record are most likely to be impacted by the upcoming rule change and should act now.

Under normal rules it is only possible to fill gaps in an NI record up to six years after the year in question, but people have until 5 April 2023 to go back an extra ten years. This is due a special concession that for a limited period people can fill historic gaps in their NI record all the way back to 2006/07.

The rule changes mean that 2016/17 would normally be the earliest year in which NI records could be filled in 2022/23, but until 5 April 2023, people can fill in gaps all the way back to 2006/07.

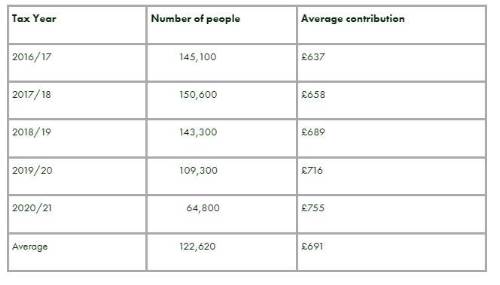

Further analysis of another previous FOI submitted show that over the last two years on average only an additional 45,000 people have made Class 3 NICs for each of the last five tax years.

People may have gaps in their National Insurance record due to a variety of reasons such as having been employed on low earnings or unemployed but not claiming benefits.

Generally, the new full state pension is paid out to those who have at least 35 years of NI contributions. You can claim the new State Pension at State Pension age if you have at least ten years National Insurance contributions and are: a man born on or after 6 April 1951 or a woman born on or after 6 April 1953. If you were born before these dates, you will get the basic State Pension instead.

According to the most up to date data available from the DWP, as of March 2020, 34% of the over 11 million people who receive the Basic State Pension did not receive the full amount equating to nearly 3.8 million people.

Similarly, around 805,000 people don’t receive the full New State Pension equating to 55% of the nearly 1.5 million people who receive this type of state pension. However, not all these people will receive less than the full state pensions because of gaps but also due to contracting out.

You can check online whether you have any gaps in your National Insurance record here: Check your National Insurance record - GOV.UK

Jon Greer, head of retirement policy at Quilter says: “Everyone’s finances are squeezed at the moment and simply having enough money for energy bills and sky-high mortgage costs may be proving difficult. However, for those people that think they might have a gap in their National Insurance record, making a Class 3 National Insurance Contributions can be a very valuable investment if you can find the money.

“In fact, someone with ten missing years could pay a little over £8,000 to fix the gaps and boost their state pension income by £55,000 over a typical 20-year retirement. If you have one or two years missing, then this might only cost you in the region of £1,400 but within just a few years of retirement you’d make your money back and more.

“Once April arrives you will have missed a golden opportunity to fill gaps that if left unfilled could have a material impact on your retirement provision so act now if you possibly can.

“If someone isn’t sure whether they have any gaps in their record the first thing to do is to go on gov.uk and use the ‘State Pension forecast” and see how much state pension you’ll get based on your current record and how much you will get if you work up to your state pension age. If you aren’t predicted to get the full amount (currently £185.15 a week) it can check for gaps in your record.

“Paying voluntary contributions won’t benefit everyone and it is key to contact the Future Pension Centre on 0800 7310175 who will be able to tell you if paying extra will increase your state pension entitlement. It could be one of the most fruitful calls you make.”

|