With less than two months to go until the introduction of the new pension reforms, just 31% of 40 to 70 year olds have spoken to anyone about the changes reveals new research from Partnership. While this rises to 37% of 56 to 60 year olds and 33% of 61 to 70 year olds, it still suggests that almost two-thirds of consumers have yet to start asking questions around what these reforms might mean for them.

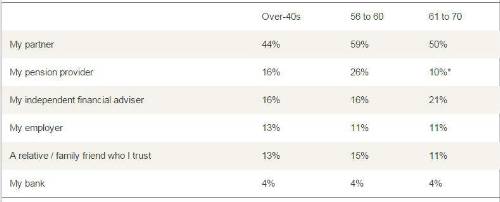

On further investigation, even those 40 to 70 year olds who have spoken to someone may only have had a casual conversation with their partner (44%) rather than their pension provider (16%) or an independent Financial Adviser (16%). This research highlights a worrying lack of engagement and suggests that come April 2015, the guidance guarantee service will be faced with a significant demand for basic information.

Of those who had spoken to someone about the changes, who have you spoken to:

While a limited number of 40 to 70 year olds have taken the proactive step of speaking to someone, 54% say that they are interested in the developments. Of these, just 21% feel up to date, 11% are actively trying to find out more and 22% admit they don’t know very much. In addition, 18% say they have ‘other things to worry about’, 10% ‘have a company scheme so feel it is not relevant’ and 8% are simply ‘not interested in pensions’.

Engagement with the new pension regime improves as people age with 61% of 61 to 70 year olds saying they were interested in the reforms. However, 13% say they have other things to worry about at the moment and 17% believe that as they are part of a company scheme the changes are not relevant to them which suggests that the need for at-retirement education high [see notes to editors for full breakdown].

Andrew Megson, Managing Director of Retirement at Partnership, said:

“While the industry is focused on what is happening with pension reforms, it is extremely worrying to see that only 31% of 40 to 70 year olds have spoken to anyone about these changes and many appear to simply have had a casual chat with their partner. While discussing aspirations for retirement is obviously important, the changes that will come into force at the start of April have the potential to significantly change how people approach retirement planning so it vital to get informed advice.

“Taking the time to read up on the changes, speak to your provider, review your existing arrangements and contact an adviser will pay off in the long run. Many of these things can be done before you speak to the Pension Wise service and also allow to you to consider issues such as how much guaranteed income you may need for life and what inheritance you may wish to leave. Even if you make no real changes, you can be secure in the knowledge that your retirement choices are the best possible ones for your situation.”

|