|

|

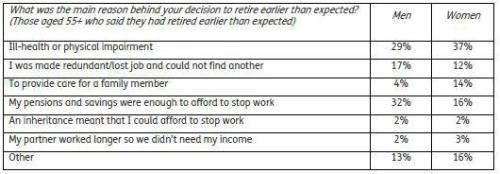

Men are most likely to retire earlier than expected because they have sufficient pensions and savings while poor health is the most common reason women retire early, new figures show. |

Research by retirement specialist Just Group among retired over-55s found nearly one in three men (32%) had the financial foundation to leave work early compared to one in six (16%) women.

Poor health was responsible for 37% of women retiring earlier than they had expected, compared to 29% of men. Women were three times as likely to have stopped work early to provide care (14%) than men (4%).

But 17% of men said they had left work early due to losing a job and not being able to find another, significantly higher than the 12% of women.

Stephen Lowe, group communications director at Just Group, said: The figures are a reminder that many

people don’t have the luxury of choosing their retirement date, particularly in times of economic turmoil.

“Government figures show four times more women than men aged 65+ have left the workforce since the coronavirus lockdowns began last March,” he said2. “Those forced out of work must make careful choices because they are less likely to have the strong financial foundation needed to last through retirement.”

He said it was important those considering using pension money took up their entitlement to free, independent and impartial Pension Wise guidance and looked at options such as State Benefits which might be available as an alternative.

“The coronavirus pandemic is likely to have encouraged some to delay retirement and others to bring it forward,” he said. “Whatever people do, it is important they avoid a knee-jerk reaction but take the time to consider their options and make an informed decision.”

|

|

|

|

| Take the lead client-facing projects ... | ||

| Various locations - Negotiable | ||

| Choose Life! Choose a major global co... | ||

| Various locations - Negotiable | ||

| Actuarial skillset? Apply now for Snr... | ||

| South East / hybrid with travel requirements - Negotiable | ||

| Financial Risk Leader - ALM Oversight | ||

| Flex / hybrid - Negotiable | ||

| Be the very model of a modern Capital... | ||

| London - Negotiable | ||

| Pensions Actuary seeking a high-impac... | ||

| London or Scotland / hybrid 3dpw office-based - Negotiable | ||

| Great opportunity for Pensions Actuar... | ||

| London or Scotland / hybrid 3dpw office-based - Negotiable | ||

| Responsible Investing Manager - Clima... | ||

| London/Hybrid - Negotiable | ||

| Quant Strategist | ||

| London/Hybrid - Negotiable | ||

| Multiple remote longevity contracts | ||

| Fully remote - Negotiable | ||

| Multiple remote inflation hedging con... | ||

| Fully remote - Negotiable | ||

| Play a vital role in shaping a new He... | ||

| London or Scotland / hybrid 50/50 - Negotiable | ||

| Support the Longevity team of a globa... | ||

| London / hybrid 2 days p/w office-based - Negotiable | ||

| Delve into financial risk within a ma... | ||

| Wales / South West / hybrid 1dpw office-based - Negotiable | ||

| Project-based Life Pricing Actuarial ... | ||

| South West / hybrid 2 dpw office-based - Negotiable | ||

| Pricing Actuary | ||

| London - £120,000 Per Annum | ||

| Develop your career in motor pricing | ||

| UK-wide / hybrid 2 dpm office-based - Negotiable | ||

| Experience real career growth in home... | ||

| UK-wide / hybrid 2 dpm office-based - Negotiable | ||

| Be at the cutting edge of technical p... | ||

| UK-wide / hybrid 2 dpm office-based - Negotiable | ||

| Use your passion for innovation and t... | ||

| London / hybrid 2 days p/w office-based - Negotiable | ||

Be the first to contribute to our definitive actuarial reference forum. Built by actuaries for actuaries.