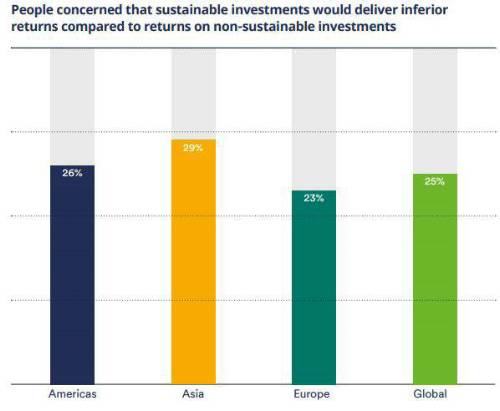

The second part of Schroders Global Investor Study 2018 - which surveyed over 22,000 investors from 30 countries* - has identified that reservations investing sustainably could be detrimental to long-term returns are in the minority.

European investors are the least concerned globally with just 23% worried investing sustainably would harm returns, with the greatest concern being among investors in Asia (29%). In particular, investors in China (39%), Indonesia (38%) and Thailand (34%) identified it as a barrier to investing sustainably.

The least concerned were investors in Japan (13%), Denmark (18%), France (19%), Belgium (19%) and Germany (20%).

The study confirmed that investing sustainably is a trend that continues to grow globally, with 64% of investors having increased their allocations over the past five years.

This reflects the 76% of investors globally stating that investing sustainably has increased in importance to them over the same timeframe.

Specifically younger people – particularly the demographics which largely comprise of ‘Millennials’ – are more likely to have increased their exposures to sustainable investments over the last five years, with 71% of 18-24 year-olds and 75% of 25-34 year-olds having increased them.

This proportion consistently drops for older age groups, culminating in 43% of investors aged 65+ having done so.

Younger people also said they allocate a larger proportion of their portfolios towards sustainable investment funds with 18-24 year-olds investing 43% of their funds in this manner, compared with 33% for the portfolios of 45-54 year-olds.

Crucially, investors who consider themselves to have a higher investment knowledge are more likely to invest sustainably.

Globally, those that considered themselves to have ‘expert’ levels of knowledge said they invest 54% of their investment portfolio sustainably.

This compares with 33% for investors who class themselves as ‘beginners’, signalling that investor education could be key to creating a more sustainable financial system – a growing focus of policymakers globally.

More than half (57%) of investors globally said that a lack of information or understanding prevented them from investing sustainably.

Jessica Ground, Global Head of Stewardship, Schroders, said: “This survey underlines the rapid growth of interest in sustainable investing. The fact that 64% of investors have increased their allocation to sustainable investments in the past five years tells you how important this is for so many people.

“Specifically, it’s encouraging to see that investors no longer appear to be held back from investing sustainably by concerns that this approach may hamper returns.

“While the demographic differences were interesting, it was particularly interesting that knowledgeable investors were more likely to invest sustainably. This emphasises the work the industry still needs to do to educate all investors about the potential benefits of investing sustainably.

“Clearly, barriers still remain preventing investors from embracing this approach, highlighting that the availability, transparency and advice around these funds requires improving.”

For the Schroders Global Investor Study 2018 full report ‘Is information the key to increasing sustainable investments?’ please click here.

The first stage of Schroders Global Investor Study, released in July, found that people globally were significantly underestimating the cost of living in retirement. It can be found here.

* In April 2018, Schroders commissioned Research Plus Ltd to conduct an independent online survey of over 22,000 people who invest from 30 countries around the globe. The countries included Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, the Netherlands, Spain, the UK and the US. This research defines “people” as those who will be investing at least €10,000 (or the equivalent) in the next 12 months and who have made changes to their investments within the last ten years

|