Fewer than one in five retirement savers aged 55+ who accessed a defined contribution pension in the last four years had a telephone or face-to-face appointment with Pension Wise, new research published by the Financial Conduct Authority (FCA) shows.

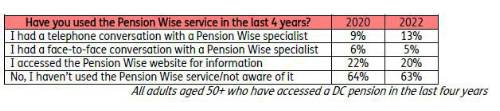

The FCA’s flagship Financial Lives research for 2022 showed 18% had a Pension Wise session, a very small increase from 15% in 2020 despite interventions to boost take-up.

Pension Wise is the core protection in place since 2015 to help consumers by giving them specialist support when making the very complex decisions about how best to access their pensions.

Stephen Lowe, group communications director at retirement specialist Just Group, said that the FCA research shows that a higher proportion of people know about Pension Wise but that hasn’t translated into higher usage.

“The majority of people know it exists but we’ve yet to see a take-off in terms of usage, especially of the one-on-one phone and face-to-face sessions with a trained specialist that are the most valuable parts of the service,” he said.

“Pension Wise gets rave reviews – 88% of those who used the service said it helped them decide what course of action to take. It doesn’t seem right that so many people are making irreversible decisions about how to use their pension savings, without getting some guidance.”

The FCA figures show 13% of those accessing pensions had a telephone appointment with a Pension Wise specialist and 5% a face-to-face appointment. The numbers may reflect a switch to telephone appointments when face-to-face sessions were halted during the pandemic.

A further one in five (20%) said they used the Pension Wise website. The remaining 63% said they did not use the service or were not aware of it.

Pension Wise was introduced in the wake of the 2015 pension ‘freedom and choice’ reforms because the government recognised “it will be important that people are equipped to make decisions that best suit their personal circumstances”.

The government has tried better signposting to the service through providers and employers, and revised ‘wake-up’ packs to promote the service. These latest FCA figures suggest that these interventions are proving ineffective. In July 2022 it introduced a ‘stronger nudge’ requirement requiring pension members wishing to access or transfer a pension to be offered a Pension Wise appointment.

MPs on the influential Work & Pensions Select Committee had recommended the government go further by setting a target of 60% in the proportion of individuals using the service and trialling ‘automatic appointments’ to set up a guidance session unless the member opted out.

“We are still waiting to see the impact of the ‘stronger nudge’ but the results from the trial suggest

the approach will prove to be too timid,” said Stephen Lowe.

“We think most pension savers should be having an appointment, especially those who are vulnerable or do not have access to financial advice. We need to see a transformation in the proportion having a session.

“The government keep rejecting proposals to test the impact of an automatic appointment pilot. But they and the FCA are pursuing no other meaningful activities to drive up Pension Wise usage. They’ve given up and are out of ideas as the data from the FCA illustrates. Should we conclude they appear content that pensions savers do not mitigate the risks they face?

“People often struggle with the complexity of pension decisions. We all have a duty to help consumers and it remains a scandal that many of those who can benefit most from a guidance session are not getting one.”

|