By Mark Harris & Chris Jaques, Managers of the CF Eden Global Multi-Strategy fund, Eden  Financial Financial

In an austere age of deleveraging it is no surprise that there is almost universal gloom and doom. However, commentators report current events but rarely factor in that markets are “discounting mechanisms” and therefore look to the future.

We believe that earnings and economic growth may surprise positively. It is at such times as these when dislocations of sentiment versus fundamentals allow for high returns on capital. This could well be reflected in the better performance of most asset classes over the next year.

However, tail risks such as the potential for a Chinese hard landing and breakdown in Europe, will result in a continuation of 2011’s heightened levels of volatility.

Global inflationary expectations look well contained for now an  d have eased significantly in many emerging markets as economic growth has slowed and food prices have come off their highs. The Federal Reserve has stated that it cannot see interest rates being raised until 2013 at the earliest. China has started easing the banks’ reserve ratio requirements and the recent LTRO in Europe will have a substantial impact on improving liquidity, and may well be an implicit form of quantitative easing. All of these measures combine to produce a very easy and stimulative monetary backdrop, with inflation less of a concern.

The US economic expansion provided some much needed substance in the final months of 2011. The short-term outlook looks predicated upon the extension of several payroll tax holidays to support personal consumption, which is a critical 70% of US GDP. Our bias errs toward the maintenance of spending, with the potential for a more positive contribution in housing construction. The US has yet to seriously address its fiscal and debt issues plus its overreliance on foreign investors to support its bond auctions, which is not an ideal situation in the medium term. If China accumulates fewer reserves and takes a dim view of Capitol Hill, then yields on US Treasuries could climb materially.

On the equity front, if companies fail to deliver expected earnings growth they will be punished but a bias towards “quality” US and UK stocks with cheap price-to-book valuations and high dividend yields is likely to be a rewarding experience.

Investors remain pessimistic (optimistic on US Dollar)

Source: ASR Ltd / Thomson Reuters Datastream, January 2012

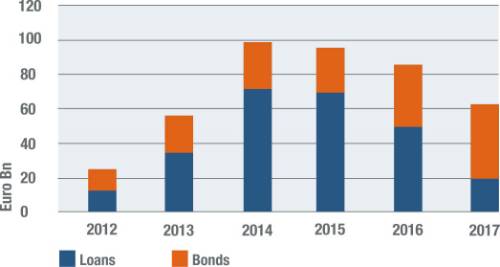

High Yield bonds look very attractive in this environment. Corporate defaults are running at low levels with Moody’s predicting a 2.3% US speculative grade debt default rate compared to current spread levels pricing in 8% over five years. We envisage defaults well below implied expectations based on corporate fundamentals, lack of a global recession and the low refinancing requirements in 2012.

Corporate Bonds – The refinancing wall has been pushed out

Source: Bloomberg, December 2011

Emerging markets started 2011 as many investors’ favoured asset class. However, rate tightening and growth fears were catalysts for performance as poor as European indices. In 2012 we have the almost inverse situation in many emerging markets, earnings expectations are lower but valuations are relatively cheap, balances sound and as inflation has significantly eased, there is the potential to slash interest rates. China has a number of issues to confront in its property markets and the shadow banking system, but has the will and reserves to create a soft landing, and it is one of our favoured equity markets.

The UK is a highly-indebted country with a low-growth trajectory. Tight fiscal controls and a large Sterling devaluation have worked their magic, so that we have extremely low Government bond market yields. It is likely that interest rates will remain low and growth may come in slightly ahead of expectations. Valuations are reasonable and the market has quality companies with good cashflow and the ability to pay dividends.

We do not envisage a marked sell off in government bonds. However with yields so low there is little reason to hold them unless you believe we are in a major economic contraction. Instead we have a bias towards Investment Grade and High Yield bonds.

Gold has halted its onward progression, and some are questioning whether the bull market is over. We firmly believe gold will be seen a lot higher in the longer term, as inflationary pressures reassert. Any further correction to the gold price in the first half of 2012 should be used as a buying opportunity by longer-term investors.

Last year was a fairly poor one for commodities, outside of gold and oil. China remains central to the return of any commodity strength; as the consumer of 40% of refined copper and 10% of the global oil supply it still dominates the demand side. We expect to see a rebound in commodity prices alongside a more general risk rally in the latter half of 2012, and as such resource equities and gold miners look attractive on a valuation basis.

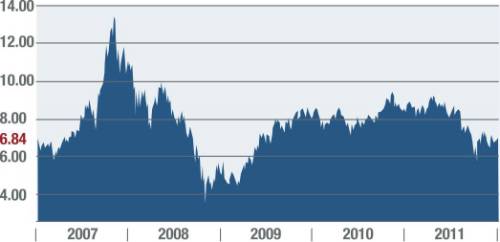

MSCI China Index – a key market for 2012

Source: Bloomberg, 29th December 2011

We are three years into a protracted deleveraging event, leading to multiple ‘mini’ economic cycles with elevated levels of volatility. There is however a supportive macro backdrop of declining and contained inflation, very low developed market interest rates and declining emerging market interest rates.

We may see economic growth stutter and corporate earnings questioned in the first quarter. In the event of any correction, we recommend buying risk assets as we believe the year will turn out to be positive for most asset classes.

|

Financial

Financial d have eased significantly in many emerging markets as economic growth has slowed and food prices have come off their highs. The Federal Reserve has stated that it cannot see interest rates being raised until 2013 at the earliest. China has started easing the banks’ reserve ratio requirements and the recent LTRO in Europe will have a substantial impact on improving liquidity, and may well be an implicit form of quantitative easing. All of these measures combine to produce a very easy and stimulative monetary backdrop, with inflation less of a concern.

d have eased significantly in many emerging markets as economic growth has slowed and food prices have come off their highs. The Federal Reserve has stated that it cannot see interest rates being raised until 2013 at the earliest. China has started easing the banks’ reserve ratio requirements and the recent LTRO in Europe will have a substantial impact on improving liquidity, and may well be an implicit form of quantitative easing. All of these measures combine to produce a very easy and stimulative monetary backdrop, with inflation less of a concern.