Research carried out by retirement specialist Just Group for its Countdown to Retirement series1 reveals a worryingly high proportion of older retirees have not yet organised a Power of Attorney, a key document safeguarding their interests should they fall ill or lose mental capacity.

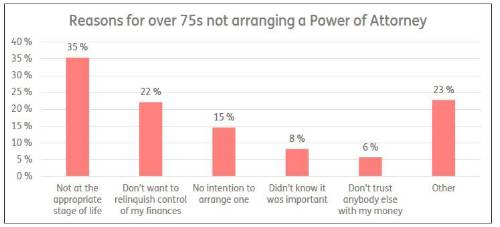

Six in 10 (59%) retirees – equivalent to around 3.4 million people2 – over the age of 75 specified that they had not yet arranged a Power of Attorney, with over a third (35%) stating that they had not established one as they didn’t feel they were yet at the appropriate stage of life.

The second most common reason given was fear of giving up control, either because they didn’t want to relinquish control of their finances (22%) or because they did not trust anybody else with their money (6%).

Other concerning findings were that one in seven (15%) said they had no intention of arranging a Power of Attorney while nearly one in 10 (8%) said they didn’t know it was important to do so.

Stephen Lowe, group communications director at retirement specialist Just Group, commented: “It is worrying that millions of people are entering later life without a Power of Attorney in place.

“None of us like to think about our vulnerabilities or impending mental and physical decline but handling the affairs of a relative without a Power of Attorney in place can be distressing and costly.”

A Power of Attorney is a legal document that enables a person – the attorney - to make decisions on behalf of another individual – the donor – if they lose the mental capacity to understand or make choices for themselves.

Powers of Attorney must be arranged when the donor still has the mental ability to make financial or medical decisions for themselves. In England, there are two separate Power of Attorney documents, one for health and welfare, the other for property and financial affairs. There are plans to modernise the system by allowing online registration.

In the event of a person losing capacity without having a lasting Power of Attorney in place, family members must apply for deputyship through the Court of Protection. Deputyship has a more limited remit than a Power of Attorney, carries an annual renewal fee of £2,500 and can cause financial difficulties in the time it takes for the Court to appoint a deputy.

“It is concerning that we found a significant proportion of over-75s stating either they did not intend to consider it or had no idea of its importance,” said Stephen Lowe

“We would strongly urge people to look at setting up a Power of Attorney at the same time as they organise or update their wills in order to provide peace of mind in later life for themselves and their family. It's concerning that a significant proportion of over-75s said they did not intend to consider establishing one or had no idea of its importance.”

|