Over 453,000 UK pensioners living abroad in retirement receive £3,000 in state pension payments annually on average – nearly £4,900 less than their counterparts who remain in the UK. This discrepancy is in part because their payments aren’t covered by the ‘triple lock’ pledge, according to new calculations by interactive investor.

The triple-lock arrangement ensures the state pension is increased each year by the highest of three measures: 2.5%, inflation, or average wage growth. However, British citizens who choose to retire outside the UK may find that their state pension payments are “frozen,” meaning their payments remain at the same rate as when they first started receiving them in the country they moved to, without adjustments for inflation or other factors that typically drive increases.

Whether a British citizen’s state pension is frozen depends on the country they move to. British citizens who move to a country in the European Economic Area, Gibraltar, Switzerland, and countries that have a social security agreement with the UK (apart from Canada or New Zealand) will continue to receive annual increases in their state pension.

More than 95% of the ‘frozen’ pensioners live in Commonwealth countries, mostly in Australia, Canada, South Africa, and New Zealand, but also in India, Pakistan, Bangladesh, many Caribbean islands, and all African countries, according to the All-Party Parliamentary Group on Frozen British Pensions.

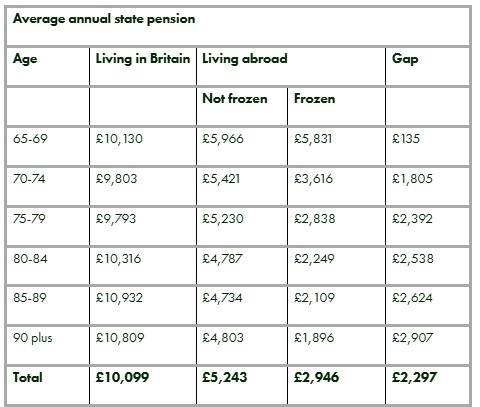

interactive investor's calculations, based on data by the Department for Work and Pensions (DWP) accurate to May 2023, show that those living overseas with a frozen state pension receive £2,300 less on average than those retirees abroad who continue to receive annual increases to their payments.

The payment gaps widen with age as the impact of the freeze compounds over time. Those in their 90s with a frozen state pension receive just £1,896 each year, compared to £4,803 for those living abroad whose pension is uprated yearly, and £6,006 less than a pensioner living in Britain.

The gulf between the average state pension paid to UK citizens who live abroad and their counterparts who remain in the UK suggests that many in the former group are also impacted by lower national insurance contributions due to living abroad during their working life. As a result, their state pension entitlement is lower.

Over 40%, or 453,481, of the 1.12 million pensioners living overseas are affected by frozen state pensions, according to DWP data. This equates to just under 4% of the 12.7 million people receiving state pension payments.

Source: DWP/interactive investor

Myron Jobson, Senior Personal Finance Analyst, interactive investor, says: “Moving abroad can be a dream come true for many Britons, especially as they approach their golden years. However, it is crucial to keep an eye on the finer details, particularly when it comes to your state pension. If you're planning to retire in a country where the UK state pension is frozen, it means you won't benefit from the annual increases that help keep up with inflation, and as such, your payments will decline in real terms throughout your retirement. This could significantly impact your financial comfort in later years, leaving some facing poverty in old age.

“Those contemplating retirement overseas should plan well in advance to ensure they’re able to enjoy a comfortable retirement. It is important to understand the state pension rules of the destination country. Those facing a frozen state pension might need to make extra contributions to their private pension or other retirement savings to offset the financial impact of the lack of uprated payments.

“By boosting your pension pot now, you can help ensure a more secure and comfortable retirement, regardless of where you choose to settle. Even modest increases can compound significantly over time to provide a boost to retirement funds.

“It is worth considering seeking advice from a financial adviser to fully understand the implications of retiring abroad and plan accordingly.”

|