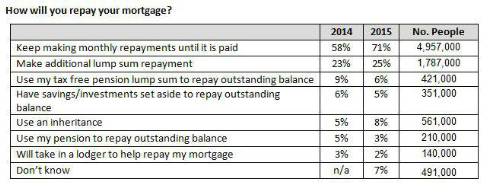

While the majority of 40 to 70 year olds with mortgages intend to meet their obligations via monthly repayments (71%) and additional lump sum contributions (25%) – up to 9% [or 631,000] intend to use their retirement savings [either entire pot or tax free cash] to repay their mortgage. This is lower than the figure recorded last year [2014 - 14%] as significantly more people are looking to more traditional methods to repay the outstanding balance on their mortgages [+13% - monthly repayments].

That said, 8% [or 561,000 people] say that they intend to rely on an inheritance to repay the outstanding balance on their property and 7% [491,000] confess they don’t know how they will meet their obligations.

Andrew Megson, Managing Director of Retirement, Partnership said:

“While it is still shocking that over half a million people in the UK intend to use all or part of their retirement savings to repay their mortgage, it has fallen from over a 1 million in 2014. This is fascinating as it suggests that the Pension Freedoms which allow people to access their entire pension in cash have encouraged people to take a more holistic view of how they use their pension rather than focusing on one-off expenditure. This in turn appears to have focused peoples’ minds on paying off their home loan before they retirement.

“The work that the lenders have done in communicating with interest-only mortgage customers about their options and obligations is also likely to have had a positive impact as it will have encouraged more people to move to capital repayment. That said, while a debt-free retirement is the ideal, some people may find they reach traditional retirement age with an outstanding balance.

“Using their pension may well seem like an option but it is not the only option as working longer, downsizing or considering a lifetime mortgage may be more appropriate. Ideally, pension savings should be used to provide an income in retirement, and with the state pension only providing a very basic safety net, making this choice could lead to hardship in later life.”

|