Analysis of the Financial Conduct Authority’s (FCA) Financial Lives Survey1 from leading independent consultancy Broadstone, reveals an alarming number of savers are unaware how much they are contributing to their pension despite a lack of confidence over their financial security in retirement.

The data shows that over a third (37%) of savers contributing to at least one Defined Contribution (DC) pension are unaware of how much is being paid into their pot, personally and by their employer.

It suggests that while inertia has been a driving force in creating millions of new pension savers, it could be acting as a drag on increasing the contributions necessary for savers to achieve an adequate standard of living in retirement.

This is highlighted by the fact that three-quarters (74%) of savers with at least one DC pension have not increased the percentage of salary that they are contributing to their pot.

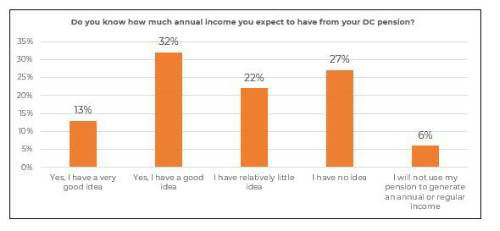

Despite this, when respondents were asked if the felt confident that their pension(s) would give them the income they hoped for in retirement, four in 10 disagreed (40%), with just a third agreeing (34%) and a quarter (25%) neither agreeing nor disagreeing. Nearly a fifth (49%) have little to no idea of the annual income they can expected from their DC pension in retirement.

Damon Hopkins, Head of DC Workplace Savings at Broadstone, commented: “It is abundantly clear that the next phase of auto-enrolment needs to see a transition from inertia to action – from the Government and employers.

“Having relied on inertia to get millions more people paying into workplace pension schemes, we need to rely on the same inertia to increase contribution rates if savers are to achieve the standard of living they desire in retirement.

“Despite lacking confidence about achieving their desired income in retirement, the FCA data shows that savers are still unaware how much they are contributing and how much income that will generate, let alone whether they’ll have enough in retirement.

“One needs to question whether for a 20 or 30-something (with varied and multiple financial aims/demands) that will ever be the case and despite the best intentions to educate and inform. Ultimately mandating higher contributions is a necessary lever in a multi-faceted solution that will achieve adequate retirement savings.

“Of course, that’s not to say increasing contributions is the silver bullet – particularly in today’s economic environment. We still need employers and providers to play an important role in nudging savers and improving their understanding of their pension and retirement needs, while also ensuring DC schemes deliver robust risk adjusted returns and value for money.”

|