The research, which was conducted amongst 150 finance decision makers in UK companies with DB pension schemes, also revealed that 76% of smaller schemes, with assets valued between £100m-£249m report running at a surplus, with this number rising for schemes between £250m-£499m (90%) and £500m-£999m (93%).

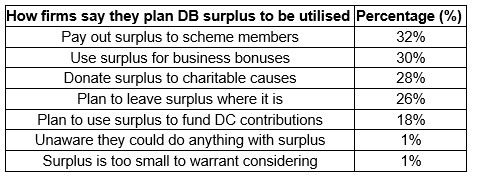

How do firms say they plan to utilise DB surplus?

With the majority of DB schemes running at a surplus, it’s necessary for firms to have a strategy in place to consider how to best utilise it - though this is proving challenging, especially for those who are in unfamiliar territory. A third (33%) are still discussing how they would like to use it.

On the other hand, a number of firms have a clearer idea, with a third (33%) saying they plan for it to be paid into the business or invested in the firm.

For the firms with schemes in surplus and plans to buy in, buy out or consolidate, the outlook appears positive. 69% say they plan for the surplus to be paid to the company – though they will need to check whether they have the power to do so under the Trust Deed and Rules. Just over three-fifth of firms (61%) say they intend the surplus to be used to increase member benefits, while over half (56%) plan to share it between members and the sponsor. A minority (3%) are still discussing what to do with their surplus.

Why are schemes not running on?

Despite the potential benefits of running on compared to buying out, three-fourths of the respondent’s schemes (76%) do not currently plan to do so. 41% believe the cost of advice for running on is too expensive, followed by 36% who believe there is too much investment risk.

The risk associated with running on is a recurring worry, with 31% believing there is too much regulatory and governance risk. 27% also believe the risk of legal challenges is too high, while a quarter (25%) are cautious the scheme may return to deficit or need further contributions.

Run-on also presents itself as more challenging than buying out. 27% of firms think it’s too expensive to have staff manage the scheme, and a quarter (25%) believe it takes too much time and brain power to do so. Similarly, one in ten (9%) do not have the capacity to manage their scheme were it to run on.

On the other hand, one in five (18%) would not know where to begin while 2% haven’t considered run-on as an option for their schemes at all.

Sankar Mahalingham, Managing Director at LawDeb Pensions, commented: “While a majority of DB schemes are reporting a surplus, many firms are undecided about how best the surplus can be utilised, for their business and for members of the schemes they sponsor. The ultimate decision may well not rest with the business, depending on the Trust Deed and Rules, and it is important for employers to engage with the trustees early to understand their views.

“Surplus is not a novel concept within the pensions industry, but harnessing it for its full potential can prove to be tricky. This becomes even more concrete with the Government’s potential pensions reforms to utilise these funds to support economic growth - while still protecting members’ benefits. Therein lies the role of an independent trustee, who should proactively engage with the sponsor, while recognising their responsibility to ensure they follow the powers under the Trust Deed and Rules, as well as acting in line with the purpose of the trust. An independent trustee can work alongside firms towards making the best decisions, both for the business and for members, rather than companies not engaging in considering which routes would be most beneficial - and potentially missing out as a result.”

|