However, though this of course provided a stern test for many schemes, new research from LawDeb, which surveyed 150 UK finance decision makers to explore the current DB pensions landscape, reveals that funding has increased for the majority of schemes since the crisis. The research shows that the LDI crisis also had a significant impact on DB schemes. For the majority of those, the result has been an increase in funding. This is most true in the short term after the event, as stated by 61% of decision makers, followed by 58% who experienced increased funding in the medium term (between two months and one year after the crisis) and 56% in the long term (over a year until now).

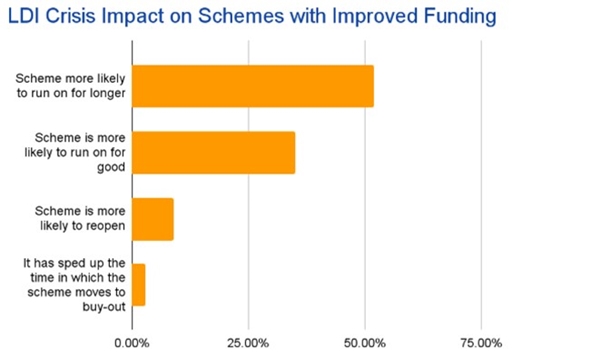

On the contrary, only 17% said that funding has worsened in the short term, followed by 15% in both the medium and long term. For those who stated that funding for their scheme has improved since the LDI crisis, it also had an impact on the way financial decision makers approach their schemes. 100% of those surveyed stated that it had an impact in one way or another, with more than half (52%) agreeing that their schemes are now likely to run-on for longer. This is followed by 35% who feel their schemes are more likely to run-on for good, and 9% who believe schemes are more likely to reopen. Only 3% feel it has accelerated the time in which a scheme will move to buy-out.

Sankar Mahalingham, Managing Director at LawDeb Pensions, commented: “There’s no doubt that the LDI crisis sent shockwaves through trustee boards and their scheme sponsors. What is now apparent is that for many schemes those turbulent weeks in 2022 led to a stronger funding (and often surplus) position, which has in turn led to corporate sponsors being more inclined to consider run-on as a possible solution in the medium or longer term. The recent Government announcement on changes to the surplus regime is therefore very timely.

“The new, more welcome, challenge for decision-makers (both corporates and trustees) is how to manage any surplus - something that may be new territory for many. An independent professional trustee can help to navigate a scheme through surplus discussions, taking account of the legal and legislative framework and balancing the paramount interests of members with consideration of the views of the sponsor as a key stakeholder.”

|