More than £2.6 billion has been stolen through investment fraud in the UK since the start of 2020, according to new research by the Pensions Management Institute (PMI). The data has been obtained using a Freedom of Information request to the City of London Police’s National Fraud Intelligence Bureau.

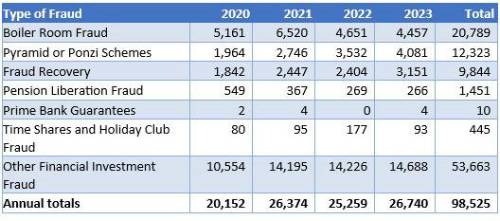

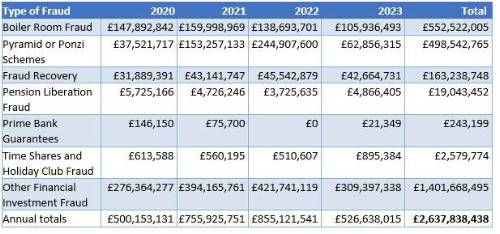

The figures show that between January 2020 and December 2023, there have been 98,525 victims of investment fraud, as criminals have stolen the equivalent of nearly £13 million every week. Victims have typically lost an average of £26,773 to these investment scams over the period.

Boiler Room fraud is one of the most common types of investment scam, costing victims £553 million over the period. This is a type of fraud where victims are cold called by fake stockbrokers and encouraged or persuaded to buy shares or bonds in worthless, non-existent, or near-bankrupt companies. Since January 2020, 20,789 people in the UK have been victims of this type of fraud.

Ponzi or pyramid schemes are another common form of investment fraud, with 12,323 victims in the UK since the start of 2020, losing £499 million. A Ponzi scheme is where investors are recruited to make payments in return for promises of abnormally high profits. However, no investment is made on their behalf. Early investors are paid returns with the investment money received from the later investors until the scheme collapses.

NUMBER OF UK VICTIMS OF INVESTMENT FRAUD

In 2023, 26,740 people were victims of investment fraud – the most victims in the four years covered in this research. These investors lost £527 million to these scams, equivalent to more than £1.4 million each day. Boiler Room frauds stole £106 million in 2023 and Ponzi schemes took £63 million.

Robert Wakefield, President of the Pensions Management Institute, said: “Our research shows that a shocking number of people are falling victim to investment fraud. It is concerning that every year thousands of people are losing millions of pounds to financial scams in the UK. The number and sophistication of investment scams is ever-growing.

“By maintaining a healthy dose of scepticism and training yourself to spot some common red flags, you may be able to protect yourself and your loved ones from becoming victims. Increasing the amount of financial education provided in schools could also help to make people more aware of the risks of investment scams.”

MONEY STOLEN IN INVESTMENT FRAUD

The FCA’s tips on spotting the warning signs for scams

• Is it unexpected. Scammers often call out of the blue. They may also try and contact you via email, text, post, social media, or even in person.

• Do you feel pressured to act quickly. Scammers might offer you a bonus or discount if you invest quickly, or they may say the opportunity is only available for a short time.

• Does the offer sound too good to be true. Fraudsters often promise tempting rewards, such as high returns on an investment.

• Is the offer exclusively for you. Scammers might claim that you’ve been specially chosen for an investment opportunity, and it should be kept a secret.

• Are they trying to flatter you. Scammers often try to build a friendship with you to put you at ease.

• Are you feeling worried or excited. Fraudsters may try to influence your emotions to get you to act.

• Are they speaking with authority. Scammers might claim that they’re authorised and often appear knowledgeable about financial products.

If you answered ‘yes’ to any of these questions, or you’re unsure if a contact is genuine, you should verify credentials.? Legitimate investment professionals and businesses in the UK are registered with the Financial Conduct Authority (FCA). You can check the FCA’s Financial Services Register?to make sure a firm or individual is authorised. Remember, some firms pretend to be authorised firms, so always use the contact details on the FS Register. The FCA also provides the ScamSmart Investment Checker that allows you to check an investment or pension opportunity you’ve been offered and avoid scams.

|