The Origo Transfer Service successfully carried out over a million pensions transfers in 2022, breaking through the one million mark for the second year running.

Over 150 brands now use the Origo Transfer Service, which handles the vast majority of the industry’s defined contribution pension transfers, making its data a reliable measurement of activity in the market. ISAs and GIAs are also transferred through the Service.

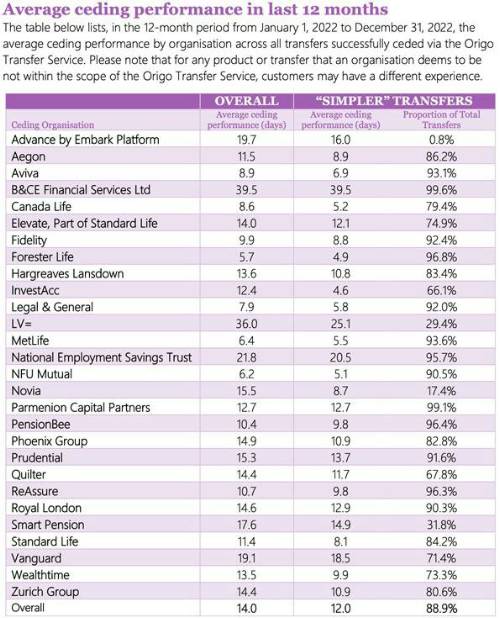

In 2022 the Service transferred over £42billion for pension holders. The average overall transfer time for providers ceding a pension in 2022, as recorded by the Service, was 14 calendar days. Half of all transfers were carried out in 7 days or less.

In addition, the Service has seen the overall number of transfers increase 34% over the past two years.

Anthony Rafferty, CEO Origo, says: “The Origo Transfer Service has had another very successful year, passing a million transfers once again, and seeing a 34% rise in volumes over the past two years. Reports from other areas of the market that transfers were down has not been reflected in the Origo Transfer Service.

“Origo is focussed on ensuring consumers get a good outcome when transferring their pension, ISA and GIA assets by providing an automated, secure transfer service, so when providers are ready to cede assets it can be done so quickly and efficiently.

“This year, alongside the focus of the FCA on consumer outcomes through the imminent Consumer Duty rules, we start to move into a new landscape where consumers will be able to access their pension data via pensions dashboards. There is the potential for around 15 million people a year to want to access their pension data and it is very possible transfer and pension consolidation activity will increase as a result. The automation of pension transfers at scale through a trusted provider will be essential.”

This quarter’s data

Overall transfer times have stayed largely stable in the quarter since October’s Transfer Index data, with an average overall transfer time of 14 days.

Data table below:

|