Heavy rains caused widespread flooding across the UK and other European countries towards the end of 2023 and at the beginning of 2024. The consequences are far-reaching, affecting communities, small businesses, infrastructure, and the economy. This continues to highlight the need to address the impact of climate change and increase investments in more weather-resilient infrastructure to protect individuals and businesses from the massive human and economic losses from extreme and more frequent weather events. Climate change and flooding are linked to the shifting weather patterns observed globally. Increased temperatures lead to more intense rainfall events, putting additional pressure on existing flood defense infrastructures.

Furthermore, the impact of floods extends beyond immediate physical losses. Displacement of communities, transportation disruption, and damage to agricultural lands can have lasting social and economic effects on the affected areas. As a consequence of the recent adverse weather events, the insurance sector in the UK as well as in continental Europe will face additional cost pressure, which will most likely result in an increase in pricing and further concerns that insurance protection will become less affordable in areas that are considered high risk.

Heavy Storms Affected Large Areas in Europe, Particularly in the UK

At the start of 2024, the UK continued to be among the countries most affected by adverse weather conditions as storm Henk brought strong winds and heavy rains on 2 January. Some areas of England recorded around 40 millimeters of rain in 24 hours, which raised river levels and left hundreds of properties flooded. In some cases, the same properties were reported flooded for the fourth time this winter after heavy storms hit the UK at the end of 2023, including storm Gerrit in the last days of December, as well as storms Babet, Ciaran, and Debi between October and November. The UK was not the only country affected, however. For instance, in the north of France, a significant area of the Pas-de-Calais department flooded at the beginning of 2024 for the second time this winter. Germany is also dealing with a serious risk of flooding because of heavy rains, with the regions of Saxon-Anhalt, Thuringia, and Lower Saxony being the most affected and the dykes— artificial walls built to prevent flooding in the proximity of a river or the sea—being at risk of becoming unstable. Similarly, some areas of Italy have been affected by severe flooding after torrential rains hit Tuscany in November 2023.

As reported by the Association of British Insurers (ABI), damages caused by floods and storms in the UK are typically covered by standard home insurance, commercial business policies, and comprehensive motor insurance policies that protect against unavoidable water damage. As such, due to the intense and prolonged adverse weather conditions, the estimated insured losses for the UK insurance sector in 2023 and 2024 are expected to be relatively high.

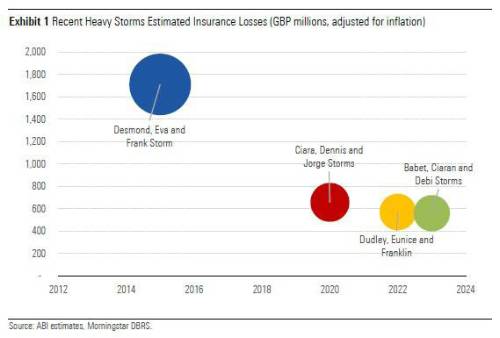

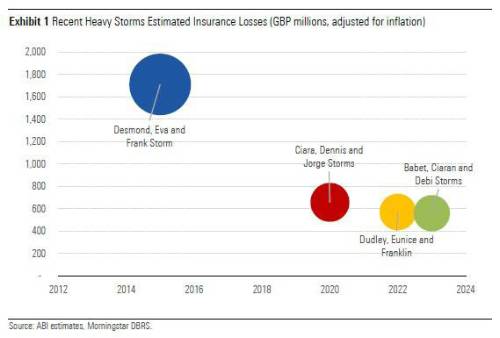

The ABI reported in December that estimated total insurance claims related to the storms Babet, Ciaran, and Debi that struck in October and November 2023 amounted to around GBP 560 million. Of that figure, around GBP 352 million was related to damaged homes, GBP 155 million to damaged businesses, and GBP 53 million to damaged vehicles. The ABI also noted that storms historically used to come as a trio. The payouts for the storms Dudley, Eunice, and Franklin, which occurred in February 2022, amounted to GBP 497 million (around GBP 570 million adjusted for inflation), and the storms Ciara, Dennis, and Jorge of February 2020 generated insurance losses of GBP 543 million (around GBP 660 million adjusted for inflation) (Exhibit 1). As a result, the expected payouts for the recent storms could be considered in line with the most recent similar events. However, this does not take into account the impact of storm Henk, which could raise the toll of total insured water damage costs to more than GBP 700 million this winter. It is also worth noting that these estimates remain lower than the total property claims in excess of GBP 1 billion caused by the Desmond, Eva, and Frank storms that occurred in the winter of 2015–16. Despite the magnitude of the initial estimated insurance losses, we consider that those remain manageable overall for our rated UK insurers.

Higher Upward Pressure on Insurance Premiums

The increased cost of claims related to floods and adverse weather events will likely pressure insurance premiums upward in 2024. We anticipate that the increase will be more pronounced for home insurance policies, which have seen the highest rise of claims directly related to adverse weather events, particularly floods. This will add further pressure on some insurance segments that are already struggling with weak underwriting profitability linked to a general increase in the cost of claims in the current high inflationary environment, such as motor insurance. As reported by Ernst & Young (EY) in October 20231, home insurance premiums were expected to rise by 17% in 2023 and a further 16% in 2024. In addition, motor insurance prices are set to rise significantly in 2023 and 2024 on the back of persistent high inflation and supply chain disruptions. According to EY2, motor insurance premiums will rise by an estimated 25% in 2023 and 10% in 2024.

Increasing premiums are raising concerns about the affordability of home insurance policies for households in areas of high flood risk. There is also a concern that some insurers may withdraw from high-risk areas, leaving homeowners and businesses unable to obtain affordable coverage. These risks are partially mitigated by FloodRe, a public-private reinsurance scheme. FloodRe is a non-profit reinsurance fund managed by the insurance industry that allows private insurers to reinsure the risk of flood to the collective fund, helping communities in high-risk areas to obtain more affordable prices for their coverage. We note FloodRe’s effective role in providing financial support to manage flood risk while raising awareness about the increased impact of climate change. However, FloodRe is planned to be in place only until 2039 and only covers homes and not businesses. In addition, only homes built before 2009 would be eligible to apply to the scheme as a means to discourage additional construction in high-risk areas.

We note that protecting communities from the risk of flood, despite the unpredictable effects of climate change, while ensuring an effective flood insurance market needs additional measures to be implemented. It remains crucial to continue investing in enhancing flood defenses and improving drainage systems across the UK with a focus on high-risk areas. Implementing property flood resilience measures for homes and businesses located in high-risk areas is also essential to maintain the affordability of insurance protection for most consumers and businesses.

1. UK home insurers experienced the worst performing year on record in 2022, with further losses expected in 2023 and 2024. Ernst & Young Press Release, 30 October 2023.

|