New analysis from Standard Life, part of Phoenix Group, highlights the pension penalty facing part-time workers when it comes to preparing for retirement. The analysis found those working three days a week for an extended period were up to £119,000 worse off by the time they reach retirement.

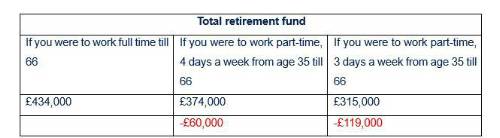

For example, someone that began working full-time with a salary of £25,000 per year and paid the standard monthly auto-enrolment contributions (3% employee, 5% employer) from age of 22, would amass a total retirement fund of £434,000 at the age of 66*. However, if they were to switch to part-time (3 days a week) from the age of 35, it would result in a total pot of £315,000 at the age of 66** – £119,000 less than if they remained working full-time.

Even switching to part time for a shorter period of ten years comes with a sizeable pension penalty. Between age 35 and 45 those working full time will accumulate £44,400, while those working three or four days would accumulate £26,600 and £35,500 respectively over the ten-year period – a difference of almost £18,000 between full-time work and three days a week***.

Potential Impact of working part-time on retirement savings

*assuming 3% salary growth per year, and 5% a year investment growth. Figures are not reduced to take effect of inflation. Annual Management Charge of 1% assumed. The figures are an illustration and are not guaranteed. Earning limits not applied.

**It is assumed from the age 35 in this example that the salary is changed on a pro rata basis for the number of days worked each week.

***When adjusted for inflation, of 2% over the period, the real value at age 66 is £181,000, part time 4 days 35-66 is £156,000 and part time 35-66 is £131,000. Working 5 days from age 35-45 would be £28,100, 4 days would be £22,500 and 3 days would be £16,900.

Gender and Ethnicity

With UK government data confirming significant differences in the percentage of people who work part-time depending on social factors like gender and ethnicity, these calculations highlight the extent of the challenge facing a society in which 23% of workers are part-time. Separately a recent study from longevity think tank Phoenix Insights found that 32% of women reduce their working hours for an extended period of time, reducing their earning potential and therefore their retirement pot.

Neil Hugh, Head of Workplace Proposition at Standard Life, said: “Making the decision to switch from full-time work to part-time work is a significant one and is often triggered by life events like having a child. The decision has an obvious short-term impact on people’s take home pay but the longer-term consequences for their retirement plans are often overlooked. The reality is that women are more than three times as likely as men to work part-time and it will often be women that have to think more carefully about whether they are on track for the retirement they want. At the Spring Budget the Chancellor announced that from September 2025 all working parents in England of children aged from 9 months will be able to access 30 hours free childcare a week, which should help those who want to stay in full-time work do so, however having children is just one of many reasons for the gender disparity – others include women taking on more caring responsibilities for adults and cultural norms in some parts of society.”

“There are steps people can take to minimise the impact part-time work can have on long-term finances. For example, it’s important to make sure you’re taking advantage of all the benefits that your pension plan offers. If your employer offers a matching scheme, and you can afford to do so, it’s worth making additional contributions so that your employer will match them. Additionally, if you have a partner, consider your retirement plans in terms of a household and the impact of working part-time could become less of an issue if you agree as a couple that one person will make additional provision."

|