Speeding drivers could face price rises of up to 74% on their car insurance if they have penalty points on their licence, according to new data.

The research, compiled by Forbes Advisor, the price comparison and financial guidance platform, looked at car insurance quotes from a range of the UK’s top insurers. It revealed that drivers with nine penalty points for speeding offences could see their premiums rise by up to 74% - with some insurers refusing to offer a quote to anyone with six or more points.

Even having as little as one point is enough to increase insurance costs by an average of 27%. While 12 points accumulated within a three-year period will see drivers being banned from driving for six months, totting up nine points could cost them anywhere between 15% and 74% more to insure their car.

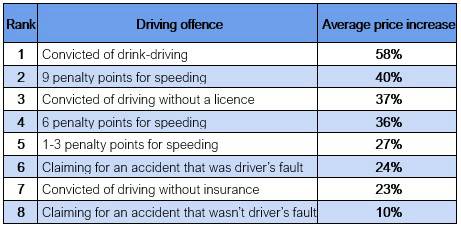

The research also looked at the statistics for more serious offences, such as drink-driving and driving without a licence. Two-thirds of the UK’s top insurers (according to Statista1) refuse to offer a quote to anyone convicted of drink-driving – and those who did, charge an average increase of 58% compared to a clean licence. Some insurers’ quotes even jumped up by 71%.

Average car insurance premium increase for driving offences

Source: Forbes Advisor

Motorists convicted of driving with no insurance or without a valid licence are also likely to run into trouble finding a new quote, with one third of insurers not willing to take on drivers committing those offences. Insurance companies that do offer quotes are likely to look for a higher price, with a 23% average price for those convicted of driving without insurance, and 37% for drivers convicted of taking to the roads without a valid licence.

Data shows that making claims, even if they weren’t the driver’s fault, can have a major impact further down the line. Claiming for an accident that was the driver’s fault will increase future insurance quotes by an average of 24% but claiming for an accident that was no fault of their own can lead to a quote being 10% higher on average – and could be as high as 21% in some cases.

Kevin Pratt, car insurance expert at Forbes Advisor, says: “Careless and reckless driving and flagrant breaches of the law attract penalty points - and points in this instance don’t mean prizes, they mean significantly higher premiums for your car insurance.

“Although many may think that insurance prices rise proportionally to the number of penalty points on a licence, our data shows drastic increases from just one to three points.

“These findings highlight the importance of driving carefully. By maintaining a clean driving record, motorists can keep the roads safe and ensure their premiums stay at a more manageable level."

|