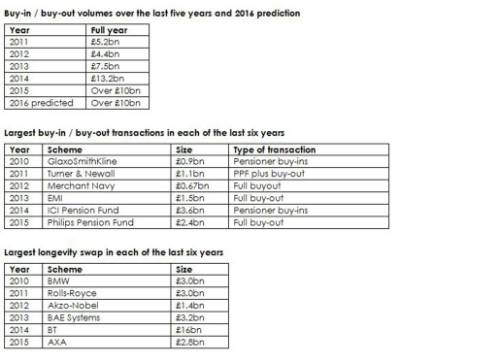

LCP’s eighth annual report – ‘LCP Pensions de-risking 2015 - Buy-ins, buy-outs and longevity swaps’ – released today (Wednesday 2 December) – says buy-in and buy-out volumes have already exceeded £10bn in 2015, making it the second highest year on record.

Charlie Finch, partner in LCP’s de-risking practice and co-author of the report, said: “The record level of competition and extra insurer capacity will be beneficial for pensioner buy-in pricing next year. All the ingredients are now in place for the market to break more records and provide cost-effective solutions to help pension plan trustees and companies transfer risk at affordable prices.”

If demand from pension plans matches the increased capacity then 2016 could be a bumper year for the buy-in, buy-out and longevity swap market in the UK, outstripping both 2014 and 2015 – the two busiest years so far.

There are three drivers for the growth in capacity:

-

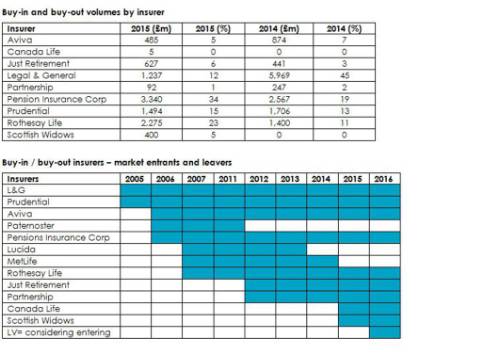

Greater competition – new competitors, such as Scottish Widows and Canada Life, have entered the market and others are considering following. This brings the market to nine active insurers – a record level.

-

Increased insurer risk appetite – greater clarity for existing insurers (such as Aviva, Legal & General and Prudential) on their capital reserves once Solvency II is in place will provide a boost in confidence.

-

Easier access for insurers to new capital to write more business – as investors will have greater clarity on the insurers’ financials.

A key driver for pension plan demand is their funding level. LCP estimates that:

-

1 in 10 FTSE 100 companies with UK pension plans are over 80% funded compared to the cost of fully insuring all the liabilities in the pension plan. Hedging longevity risk through a buy-in or longevity swap becomes increasingly attractive as pension plans gets closer to full funding.

-

This would double to 1 in 5 FTSE 100 companies if there was a 15% rise in equities and similar assets. It would more than triple to 1 in 3 FTSE 100 companies with a 30% rise.

2015 saw caution from some insurers – as they grappled with the final details emerging on Solvency II – meaning that volumes of transactions in 2015 were depressed compared with 2014, which was a record year for buy-ins, buy-outs and longevity swaps. Despite this, volumes of buy-ins and buy-outs have already reached £10bn in 2015 (£13.2bn in 2014). There have been five longevity swaps hedging £9.3bn in 2015 (2014: three longevity swaps hedging £21.9bn).

Finch added: “2015 has been a challenging year for insurers as they got to grips with Solvency II but buy-in and buy-out volumes have still hit £10bn. The light is now at the end of the tunnel and we forecast buy-in and buy-out capacity will grow to over £15bn in 2016.”

“We anticipate that some insurers will seek to transfer historic annuity business to other insurers in 2016 as they refocus priorities under Solvency II. This will have the effect of competing for insurer capacity for buy-ins and buy-outs, reducing the capacity available to pension plans.

Finch concluded, “Things could change very quickly. The delicate balance between supply and demand means that – despite the increase in insurer capacity – demand could quickly outpace supply, especially if investment markets improve pension plan funding levels.”

Key data from the LCP Buy-Ins, Buy-outs and Longevity Swaps Report

To download the complete report please download the document below

|