On 29 July the Government announced the winter fuel payment would be axed for pensioners unless they were claiming pension credit.

The Winter Fuel Payment is worth up to £300 a year, with the exact amount dependent on your age and whether other people in your household also qualify.

The government has been facing increasing pressure to reverse this decision, including from unions and its own back benchers.

Key week for pension incomes, with average earnings growth figures for July published this week set to determine the ‘triple-lock’ state pension increase in 2025.

The triple-lock pledge means the state pension will rise by the highest of average earnings growth, inflation or 2.5%

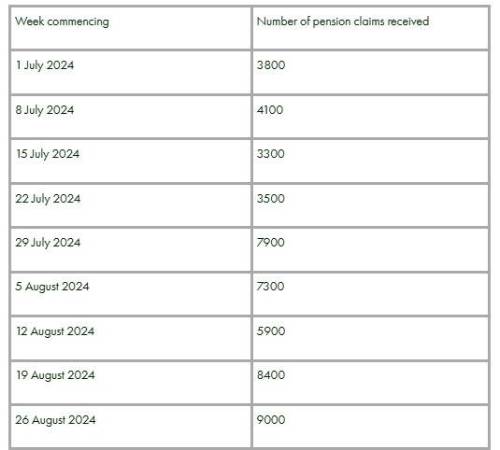

Rachel Vahey, head of public policy at AJ Bell, comments: “The government’s shock decision to axe the winter fuel payment has prompted the UK’s pensioners to put in claims for pension credit benefits, with the number of claims doubling since the announcement on 29 July.

“This shows the UK’s pensioners are acting fast. Previous government estimates* suggest just 6-in-10 people who are eligible for pension credit make an application, potentially costing those on the lowest incomes thousands of pounds in lost income. Those rushing to fill in the forms will be wanting to keep a hold of the £300 winter fuel payment, but could also access other valuable benefits, including dental treatment and free TV licenses. But there are still too many pensioners potentially missing out, and the government needs to keep banging the drum to urge these people to claim these valuable benefits.

“This comes in what could be a crucial week for the state pension. The Government is facing increasing pressure to ‘u-turn’ its controversial decision to axe the winter fuel payment, with pressure coming not only from the opposition, but from unions and its own backbenchers too.

“Tomorrow also sees the publication of the average earnings growth figures for July, which, with the recent subdued inflation figures, will likely set the increase in the state pension next year under the triple lock guarantee.

“If average earnings grow by 4.5% in July, as they did in June, retirees in receipt of the full new state pension will be in line for a state pension boost worth over £500 next year. This would also push the full value of the state pension beyond £12,000 a year for the first time.

“Pension credit is also likely to get a proportionate boost linked to wages from April, yet another reason for low income pensioners to claim.”

Pension credit explained

Pension credit is a key benefit provided by the state which often tends to go unclaimed by lower income retirees.

In 2024/25, if you are over state pension age (66), single and your income is less than £218.15 a week then pension credit will top you up to that amount. For a couple, the combined income figure is £332.95.

In relation to pension credit, your income includes your state pension, other pensions, employment or self-employment earnings and most social security benefits. As with the state pension, it is up to you to claim pension credit.

For those who are entitled to receive it, claiming pension credit is also really important because it acts as a gateway to other benefits, such as help with heating costs, housing benefit, dental treatment and free TV licenses (if you are aged 75 or over). The decision to end universal Winter Fuel Payments means it also becomes a gateway to means tested Winter Fuel Payment.

*Source: Income-related benefits: estimates of take-up: financial year ending 2022

Weekly Pension Credit claims received from 1 July 2024 to 1 September 2024

Source: DWP Pension Credit claims

|