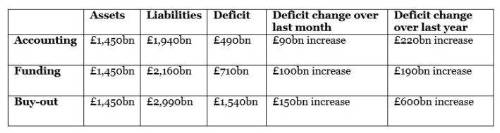

PwC’s Skyval Index provides a health check of the UK’s c.6, 000 DB pension funds, using three measures:

· Accounting: the value of liabilities shown in company accounts.

· Funding: the value of liabilities used by pension fund trustees to determine company cash contributions.

· Buy-out: the value an insurer would place on the fund's liabilities.

As of 29 August 2016, the Skyval Index asset, liability and deficit levels of DB pension funds are:

Raj Mody, partner and PwC’s global head of pensions, said: “With the prospect of further action from the Bank of England to reassure the economy in these uncertain times, the challenging environment for pension funds is likely to endure for several years. PwC’s recent pensions risk survey showed that half of funds had not protected themselves against falls in long-term interest rates.

“Companies and pension fund trustees should revisit their approach to the risk profile of their pension fund. They should also ask themselves if gilt yield measurements are still relevant for them when deciding how to measure and finance the deficit. There may be more appropriate measures that are better tailored to their own fund's strategy. This will give a more realistic view for trustees and sponsors helping them to make more effective decisions.”

PwC is advising pension trustees and company sponsors not to over-react to the large deficit figures they see in the headlines, whether for their own funds or for the industry generally. Figures showing the deficit being in excess of £1trn assumes that the majority of pension funds look to buy-out their liabilities with insurers. This is a hypothetical scenario which does not reflect the reality for how most pension funds will be managed over the next few years.

Raj Mody, partner and PwC’s global head of pensions, concluded: "Pension decision-makers should understand the assumptions which sit behind any analysis presented to them around pension risk or deficit. Transparency is critical to avoid making inappropriate decisions."

|