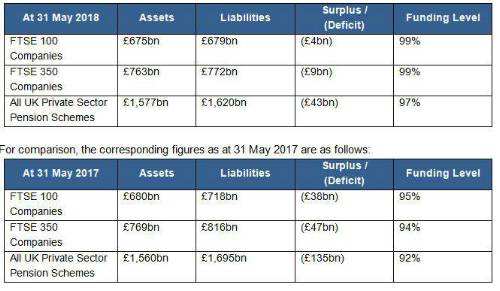

As at 31 May 2018, JLT estimates the total DB pension scheme funding position as follows:

Charles Cowling, Director, JLT Employee Benefits, comments: “Markets continue to be positive for pension schemes and overall reported pension deficits are showing a strong improvement from twelve months ago. Indeed, the FTSE 100 is very close to showing an aggregate surplus in its pension schemes for the first time in a decade.

“However, crucial for pension schemes, is the outlook for interest rates. It had been thought likely that the Bank of England’s Monetary Policy Committee would raise interest rates at their meeting on May 10th but that did not materialise. Indeed, two factors suggest that the next rise in interest rates could be some months away yet. Firstly, there were positive signs on inflation with the latest figures revealing a headline rate of 2.2%, down from 2.3% last month. Secondly there has been a change announced to the Bank of England’s Monetary Policy Committee this month, with Professor Jonathan Haskel set to replace Ian McCafferty from September. Professor Haskel is an academic economist and productivity expert at Imperial College London. He is expected to bring insights and understanding on the UK economic outlook at a time when there are increasing signs of the economy stuttering with Brexit looming imminently. He replaces Mr McCafferty, who has consistently been one of the more hawkish members of the MPC, voting against the majority in favour of raising interest rates.

“The other interesting personnel change for pension schemes is the news that Lesley Titcomb is to stand down as head of the Pensions Regulator in February, at the end of her term of office. Given the recent Government White Paper on Protecting Defined Benefit Pension Schemes promising a tougher stance on pension funding and a vocal and critical Work and Pensions Select Committee, it is possible that this may signal politicians’ intent to ramp up their attention towards pensions.

“So this latest good news in markets may just be the calm before the storm. Perhaps this should trigger companies and pension schemes to take advantage of the current relative good times and seek opportunities to de-risk and settle liabilities whilst they can.”

|