Pension fund performance remains significant, not only in delivering larger pension pots, but also in helping to ensure drawdown strategies remain sustainable. In 2016 and 2017, this was less of a concern as the average pension fund delivered double-digit growth of 15.7% and 10.5% respectively.

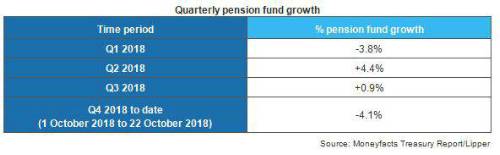

However, pension fund returns have been subject to increased volatility in 2018. The average pension fund fell by 3.8% during Q1 2018 before rising by 4.4% in Q2 2018. Pension fund returns proved more subdued in Q3 2018, rising by just 0.9%, with almost 40% of funds failing to deliver any growth at all.

By the end of Q3 2018, the average pension fund was up by only 1.2% this calendar year. But pension funds have made a poor start to Q4 2018, falling by 4.1%. This trend puts average pension fund returns on course for a fall of 2.9% in 2018, its first year of losses since 2011.

The drop-off in pension fund performance comes at a time when the latest Financial Conduct Authority data shows that for drawdown policies where a regular withdrawal is being made, the withdrawal rate has increased from 4.7% in 2016/17 to 5.9% in 2017/18, a level that raises questions of sustainability over the long-term.

Richard Eagling, Head of Pensions at Moneyfacts, said: “Pension freedoms have placed a much greater onus on individuals to take control of their own retirement planning, and in an environment where freedom has been so positively promoted, it is no surprise that the most flexible decumulation product drawdown has become the most popular choice. However, in facilitating this trend pension freedoms have encouraged far greater numbers of individuals to take on the longevity and investment risks associated with drawdown themselves.

"It is still unclear as to whether drawdown customers are making sustainable withdrawals, although the fact that the average pension fund is down by 2.9% so far this year indicates that this could soon be a greater issue.”

The Moneyfacts UK Personal Pension Trends Treasury Report provides a comprehensive review of the UK personal pension and annuity sectors, with detailed analysis of annuity rates, pension fund returns and maturity values.

|