By Fiona Tait, Technical Director, Intelligent Pensions

In terms of consumer choice, it has been remarkably consistent. In round numbers:

• 55% of people are encashing their pensions in full

• 30% are using flexible access drawdown

• 10% are buying an annuity, and

• 5% are using the unhelpfully titled UFPLS (Unregulated Funds Pension Lump Sum).

When pension freedoms were introduced most commentators expected a spike of people cashing in their pension funds to access cash; this was a new opportunity for a windfall that was simply too tempting for some. However, what the FCA data clearly shows is that high levels of full pension encashments have continued and it shows no signs of slowing.

While most of these full cash withdrawals are for ‘small pots’, there has been a consistent stream of people with larger pension funds making full cash withdrawals. Approximately 1,500 people every six months cash in a pension with a value over £100k and some significantly higher. This will give rise to a large tax bill and one wonders why they need to access their pension in this way.

Worryingly, the Citizens Advice Bureau found that a third of those cashing in a pension over £100k were simply holding the proceeds in their bank account where it is guaranteed to be eroded by inflation over time.

Pensions are the most tax efficient and flexible investment you can have. To take money out that isn’t really needed makes no sense at all. Clearly, there are consumer trust issues where pensions are concerned and that distrust extends to the products, the industry and the Government potentially changing the rules.

The rate at which people are cashing in their pension signals a big problem further down the line. These people are still spending their new windfall but how long will it last and how many have other pensions and savings to maintain their standard of living? We are likely to see a rapidly growing rate of pensioner poverty which is very concerning.

Pension freedoms and choice has had many positive benefits, pensions have become dinner party conversation and people want to talk about their retirement, but there is no doubt it has also increased the complexity.

The Government launched Pension Wise in recognition of the added complexity to help people access free guidance about their pension options. Take up of the Pension Wise service has been slow and promotion of the service sometimes lacking, and it must also be remembered this is a guidance service only so can’t tell someone what to do and doesn’t come with any regulatory protection.

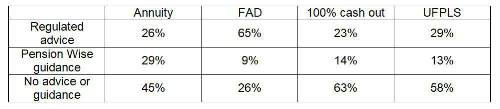

The trends for taking advice or guidance have been reasonably consistent but there are small signs of a general decline in people taking advice/guidance and a more marked decline specifically for UFPLS which has seen those taking advice/guidance falling from 56% in the April 2018 data to just 42% in the March 2020 data.

Flexi access drawdown (FAD) is certainly the most complicated of all the pension choices as it requires ongoing management and investment, so it is pleasing to see this ranks the highest for seeking advice and/or guidance. That said, the figures show over a quarter of FAD investors are managing their plan themselves yet many are unlikely to have the skills and experience to be aware of the various risks at play, let alone manage them effectively.

Probably the biggest challenge for most FAD investors is taking a sustainable income. A minority of investors are overly-conservative and could drawdown more but the bigger concern is those people drawing down their pension too quickly so that it’s at risk of expiring well before they do. There can be good reasons for taking a higher withdrawal rate, to bridge the period before receiving state pension for example, but the FCA data shows approximately 74% of FAD investors are drawing more than 4% per annum and that does set alarm bells ringing.

While it may not be obvious from my commentary, I am a great supporter of pension freedoms and choice, but as an industry we need to educate and help consumers to ensure they don’t spend their pensions too quickly and run the risk that they will not have enough income in later life.

|