In total, just over £200bn was paid out of the FTSE350 DB pension schemes to members from 2015 to 2020. This figure is around £45bn higher due to the introduction of the pension flexibilities as part of the “Freedom and Choice” reforms.

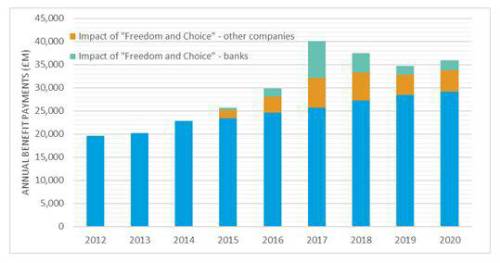

The chart below shows the estimated impact of the “Freedom and Choice” reforms, by splitting the benefits paid from the FTSE350 DB schemes between the amounts anticipated prior to the “Freedom and Choice” reforms, and the estimated amounts arising following the introduction of the “Freedom and Choice” reforms.

The increased outflow since 2015 is a result of members transferring the capital value of their DB pension to an alternative (typically defined contribution (DC)) pension arrangement.

The UK’s four largest banks have seen an especially high outflow of transfer payments, with Barclays leading the way with £4.2bn paid out in 2017.

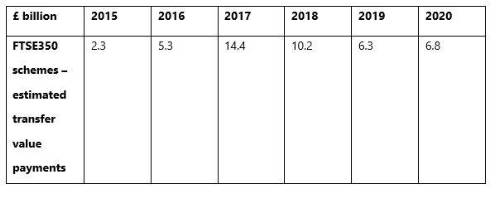

Looking at the yearly totals, shown in the table below, there was a spike in transfer activity in 2017, with an estimated £14.4bn of transfer values paid out of FTSE350 DB schemes. There has been a slowdown in transfer activity over recent years, with an estimated £6.8bn paid out in 2020.

The slowdown in DB transfer activity is a result of a number of factors, which include:

• Increasing regulation relating to the DB transfer advice process;

• A ban on contingent charging structures for DB transfer advice;

• A shrinking in the number of financial advisers willing or able to advise on DB transfers;

• Negative press coverage relating to specific transfer value cases and wider awareness of pension scams; and

• Covid-19 causing companies and trustees to be more cautious in carrying out large, one-off transfer exercises.

Simon Taylor, Partner at Barnett Waddingham, said: “This data shows the incredible impact that the “Freedom and Choice” reforms have had on the decisions of those retiring over the last 5 years. There has clearly been a huge amount of demand from members of DB schemes to access their pension more flexibly and draw income in a way that best suits their needs. Whilst welcome, the increased regulation in this area has made it more challenging for individuals to access suitable financial advice at a reasonable cost. We do expect to see a lower level of transfer activity over the coming years as a result of the increased regulation, but there will undoubtedly be an underlying level of demand from members to continue exploring this option. Companies and trustees should strongly consider putting in place a robust support framework for DB members to ensure that they are able to make the right decision at this important point of their financial journey.”

|