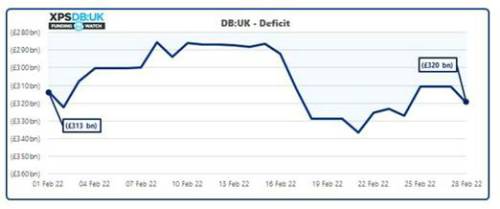

Deficits of UK pension schemes have increased by c.£7bn over the month to 28 February 2022 against long-term funding targets, an analysis from XPS’s DB:UK funding tracker has revealed. Based on assets of £1,777bn and liabilities of £2,097bn, the average funding level of UK pension schemes on a long-term target basis was 85% as of 28 February 2022. XPS estimates that at the end of February 2022 the average pension scheme would need an additional £31,000 per member to ensure it can pay their pensions into the long-term.

Drivers of the change

The change in funding levels over February was relatively small. Liabilities fell due to rises in gilt yields, partially offset by further rises in inflation. Whilst this move will have generally been beneficial for the funding level of pension schemes that are not yet fully hedged, a simultaneous decline in growth market assets will have negatively impacted most UK pension scheme funding levels over the month.

Growth assets continued to react negatively to the prospect of monetary policy measures to combat inflationary pressures, as well as the impact of the escalation of conflict in Ukraine.

Russia-Ukraine conflict

Whilst attributing market movements to specific events is problematic, global markets experienced significant swings over the last month as the likelihood of conflict in Ukraine increased.

Market falls have reflected loss the impact on international trade and supply side disruption given the interconnectedness of the global economy. European equity markets experienced a sharp shock with the FTSE 100 and Euro Stoxx indexes both falling around 4% on the day of the invasion. Whilst this drop in prices reversed shortly after, equity markets can be expected to continue to remain volatile for the time being.

Inflation will also continue to be at the forefront of investor concerns as the conflict further exacerbates supply chain difficulties and rising energy prices. Russia and Ukraine both contribute meaningfully to the worldwide supply of commodities, with European energy supply particularly dependent on Russian gas exports. As a result, cost-push inflation can be expected to put upwards pressure on prices, introducing further challenges for monetary authorities already stretched with post covid efforts.

Simeon Willis, Chief Investment Officer at XPS said: “The scope for the situation to deteriorate further is self-evident. However, markets are forward looking and therefore current news and the potential for further deterioration may already be factored into prices. Consequently, this may not represent a sensible time for wholescale changes in strategy. That said, if your portfolio does not currently reflect your risk tolerance and you wish to make changes, it is important to recognise the significant intra-day price fluctuations. This can be managed by approaches such as pre-investing trades to reduce time out of the market and breaking up transactions across a number of smaller trades.”

|