|

|

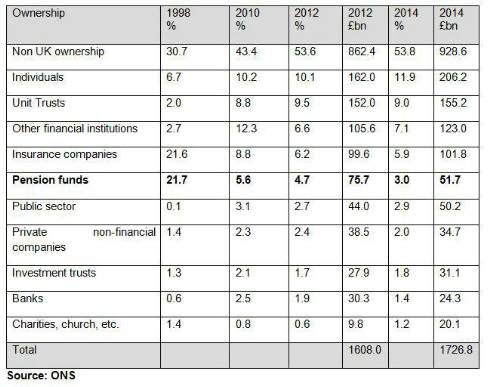

Schemes de-risking and diversifying to protect funding position. Pensions funds’ ownership of UK quoted shares fell from 4.7% in 2012 to 3% in 2014, the lowest ever recorded and a drop in value of £24 bn from £75.7 bn in 2012 to £51.7 bn in 2014. |

The findings are revealed in the latest ONS Report undertaken with contributions by Equiniti.

Duncan Watson, Managing Director of Data Solutions at Equiniti says;

“Pension funds are side stepping volatility, diversifying and de-risking. Mature schemes are looking for exposure to gilts and fixed interest while others are reacting to market highs by crystallising gains. Schemes are also taking advantage of buy-out opportunities.

Behind this trend sits the need to protect funding positions by finding lower risk strategies and absolute returns.

“The fall in ownership also illustrates the difficulties schemes face in participating in the government’s call to invest in long term infrastructure products; it is little surprise that these are largely the reserve of public sector schemes.

“The switch to gilts comes despite the Bank of England’s Quantitative Easing (QE) programme. The BoE has bought approximately £375 billion of gilts under QE since start of the programme in 2009”

The ONS report reveals that in 1963, the proportion of shares held by pension funds was 6%, growing to a high of 32% in 1992. Since then pensions funds’ holdings have fallen.

The split in ownership by pensions funds between FTSE 100 and other UK quoted companies has also dropped, from 85% in 2012 to 83% in 2014. Only individual investors had a much wider split of investments with 38.9% in the broader market, up from 28% in 2012, and 61.1% in the FTSE 100, down from 72% in the 2012.

|

|

|

|

| Take the lead client-facing projects ... | ||

| Various locations - Negotiable | ||

| Choose Life! Choose a major global co... | ||

| Various locations - Negotiable | ||

| Actuarial skillset? Apply now for Snr... | ||

| South East / hybrid with travel requirements - Negotiable | ||

| Financial Risk Leader - ALM Oversight | ||

| Flex / hybrid - Negotiable | ||

| Be the very model of a modern Capital... | ||

| London - Negotiable | ||

| Pensions Actuary seeking a high-impac... | ||

| London or Scotland / hybrid 3dpw office-based - Negotiable | ||

| Great opportunity for Pensions Actuar... | ||

| London or Scotland / hybrid 3dpw office-based - Negotiable | ||

| Responsible Investing Manager - Clima... | ||

| London/Hybrid - Negotiable | ||

| Quant Strategist | ||

| London/Hybrid - Negotiable | ||

| Multiple remote longevity contracts | ||

| Fully remote - Negotiable | ||

| Multiple remote inflation hedging con... | ||

| Fully remote - Negotiable | ||

| Play a vital role in shaping a new He... | ||

| London or Scotland / hybrid 50/50 - Negotiable | ||

| Support the Longevity team of a globa... | ||

| London / hybrid 2 days p/w office-based - Negotiable | ||

| Delve into financial risk within a ma... | ||

| Wales / South West / hybrid 1dpw office-based - Negotiable | ||

| Project-based Life Pricing Actuarial ... | ||

| South West / hybrid 2 dpw office-based - Negotiable | ||

| Pricing Actuary | ||

| London - £120,000 Per Annum | ||

| Develop your career in motor pricing | ||

| UK-wide / hybrid 2 dpm office-based - Negotiable | ||

| Experience real career growth in home... | ||

| UK-wide / hybrid 2 dpm office-based - Negotiable | ||

| Be at the cutting edge of technical p... | ||

| UK-wide / hybrid 2 dpm office-based - Negotiable | ||

| Use your passion for innovation and t... | ||

| London / hybrid 2 days p/w office-based - Negotiable | ||

Be the first to contribute to our definitive actuarial reference forum. Built by actuaries for actuaries.