Measuring 34 pension systems, the Index shows that the Netherlands and Denmark (with scores of 80.3 and 80.2 respectively) both offer A-Grade world class retirement income systems with good benefits - clearly demonstrating their preparedness for tomorrow’s ageing world.

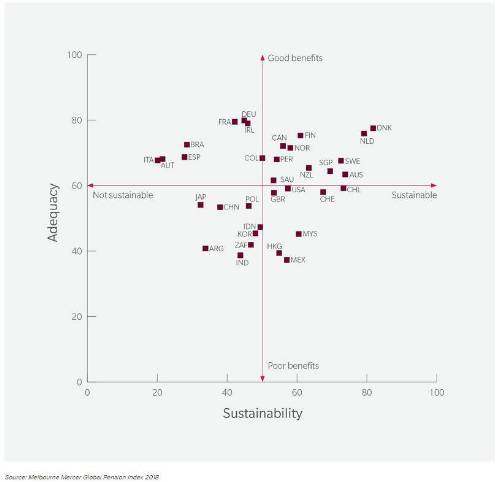

However, common across all results was the growing tension between adequacy and sustainability. This was particularly evident when examining Europe’s results. Denmark, Netherlands and Sweden score A or B grades for both adequacy and sustainability, whereas Austria, Italy and Spain score a B grade for adequacy but an E grade for sustainability thereby pointing to important areas needing reform.

Author of the study and Senior Partner at Mercer Australia, Dr David Knox says that the natural starting place to having a world class pension system is ensuring the right balance between adequacy and sustainability.

“It’s a challenge that policymakers are grappling with,” says Dr Knox. “For example, a system providing very generous benefits in the short-term is unlikely to be sustainable, whereas a system that is sustainable over many years could be providing very modest benefits. The question is – what’s an appropriate trade-off?”

As highlighted in Chart 1, all systems should consider adjusting their strategy so they are moving towards the top right quadrant. Through the study, policymakers can understand the characteristics of leading systems and find ways to improve their own.

Chart 1: Adequacy versus Sustainability ratings for global pension systems

Dr Knox adds that it’s not enough for a system to be sustainable or adequate; an emerging dimension to the debate about what constitutes a world class system is “coverage” and the proportion of the adult population participating in the system.

“In some countries, broad coverage has been successfully accomplished through compulsory workplace pension systems or, in some cases, auto-enrolment arrangements,” he says.

“However, with changes in the way people are working around the world, we need to ensure these schemes include everyone so that the whole workforce is saving for the future. This includes contractors, self-employed, and anyone on any income support, be that parental leave, disability income or unemployed benefits.”

Brian Henderson, Partner at Mercer said “The UK scored well on the integrity of its pension system, with a sound approach to regulation and governance, but must take action now to increase provision for low earners and the self-employed.

“Measures are underway to improve the UK’s global standing, but this alone will not be sufficient. For example, the UK will benefit from the impact auto-enrolment as the number of employees participating in private pension schemes grows and levels of pension savings improves, particularly with minimum contributions increasing from 5% to 8% in April 2019. Furthermore, the Pension Regulator's assurance framework for master trusts will drive improvements, and so will the continued consolidation of smaller savings vehicles into larger pools, although employers need to play an active role here.

“More widely, with a tight labour market, employers should attract and retain talent by improving workplace pension schemes. This can improve the financial wellbeing of employees and create a more productive workforce,” he said.

“Ageing populations, high sovereign debt levels in some countries and the global competition to lower taxes constrain the ability of some jurisdictions to improve retirement income security. With a decade of unique data, the MMGPI and associated research can provide valuable global comparative insights to planners and policymakers on the way forward,” said Professor Deep Kapur, Director of Australian Centre for Financial Studies.

Supported by the Victorian Government and bringing together the best minds in Australia’s financial services and research expertise fields, the Index is testament to Victoria’s dominant position in the superannuation and financial services sectors.

Minister for Industry and Employment, The Honourable Ben Carroll, said that the result demonstrates the success of Victoria’s thriving financial sector, which is home to approximately 60 per cent of the nation's institutional investors.

“Melbourne is the undisputed capital of Australia's pension industry and is home to six of the eight largest industry superannuation funds in the country. Our top four funds manage AU$300 billion, demonstrating the ongoing success of Victoria’s strong and sophisticated financial services sector.”

What does the future look like?

Some pension systems face a steeper path to long term sustainability than others, and all start from a different origin with their own unique factors at play. Nevertheless, every country can take action and move towards a better system. In the long-term, there is no perfect pension system, but the principles of “best practice” are clear and nations should consider creating policy and economic conditions that make the required changes possible.

With the desired outcome of creating better lives, this year’s Index provides a deeper and richer interpretation of the global pension systems. Having now expanded to include Hong Kong SAR, Peru, Saudi Arabia and Spain; the Index measures 34 systems against more than 40 indicators to gauge their adequacy, sustainability and integrity. This approach highlights an important purpose of the Index – to enable comparisons of different systems around the world with a range of design features operating within different contexts and cultures.

Melbourne Mercer Global Pension Index by the Numbers

This year’s Index reveals that many North-Western European countries lead the world in developing world class pension systems. The Netherlands, with an overall score of 80.3, beat Denmark to first place, a spot held by Denmark for six years, by 0.1. Finland bumped Australia (72.6) out of third place with an overall score of 74.5 and Sweden (72.5) coming in fifth place.

“The Index is an important reference for policymakers around the world to learn from the most adequate and sustainable systems,” Dr Knox said. “We know there is no perfect system that can be applied universally, but there are many common features that can be shared for better outcomes.”

Melbourne Mercer Global Pension Index – Overall index value results

The Index uses three sub-indices – adequacy, sustainability and integrity – to measure each retirement income system against more than 40 indicators. The following table shows the overall index value for each country, together with the index value for each of the three sub-indices: adequacy, sustainability, and integrity. Each index value represents a score between zero and 100.

|