Many employees will see take-home squeezed further in April as any pay rises are likely to be wiped out by soaring inflation, the continued freeze in income tax thresholds and the increase in National Insurance rates. Aegon highlights how those tempted to pause pension contributions to ease financial pressures could miss out on thousands of pounds in retirement.

The latest inflation rate shows CPI is currently sitting at a 30-year high of 7%, 3% above average wage growth, and is set to rise further as April’s energy price cap increase bites in the coming months.

Despite the climate of rampant inflation, the Chancellor has stuck to his previous decision not to increase income tax thresholds, which have been frozen at their 2020/21 rates until April 2026. While in the past such ‘stealth tax’ measures have often gone unnoticed, soaring inflation and even modest wage rises will push many more taxpayers into higher tax brackets over time. Many employees who receive a pay rise this April could find themselves paying a larger proportion of their salary in income tax.

Alongside this, employees will see the impact of the UK-wide National Insurance rate increase for the first time in April payslips as the 1.25 percentage point rise takes effect. The rise will mean a reduction in employees’ take-home pay as well as an increase in employers’ payroll costs. From July 2022, however, some employees will see this remedied as an increase in the NI threshold from £9,880 to £12,570 will offset some, if not all, of April’s NI rate rise.

Pausing pension contributions

With pay packets squeezed, some people may look for ways to relieve financial pressures in the coming months. They could be tempted to pause workplace pension contributions for a period to boost take-home pay. However, stopping pension contributions isn’t a decision to be taken lightly and those tempted should consider the long-term consequences.

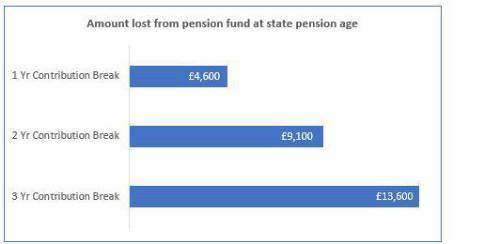

Aegon analysis shows a one-year pension contribution break could mean a 25-year-old on average earnings, and contributing the minimum auto-enrolment level, could miss out on £4,600 at state pension age (in today’s money terms). Pausing pension contributions for two years could mean missing out on £9,100 and three years could mean missing out on £13,600. This assumes, as is highly likely, their employer also stops contributions to their pension.

Table 1 - Aegon Analysis, April 2022. Values in today’s money terms adjusted for 2% inflation. Assumes: Pension break begins Age 25, total pension contribution 8%, Salary £29k increasing 3% annually, investment growth 4.25% (incl. fees)

For this same employee, a one-year pension break would mean missing out on £683 of contributions from their employer. Forfeiting these valuable contributions effectively means you lose out on ‘free’ money from the employer which can boost retirement savings significantly. The monthly saving from take-home pay would be £75.

Kate Smith, Head of Pensions at Aegon comments: “When people’s pay for April hits their bank accounts, it will drive home the impact of the cost-of-living squeeze. Following the government’s announcement last September that National Insurance rates would rise by 1.25p in the pound to support the NHS and social care funding, April has been earmarked as the month when employees would see their tax burden rise.

“This is being compounded by the continued freeze on income tax bands dragging more people into paying a larger proportion of their salary on income tax as wages rise. However, since these decisions were made, inflation has risen to a 30-year high eroding the purchasing power of take-home pay at an alarming rate.”

“This ‘triple whammy’ of factors hitting April’s pay packets will no doubt cause people to look to areas that can ease the financial pressures. However, those looking to cut back on their pension contributions should carefully consider the long-term effects before making any decisions. While there may be a small immediate boost to take-home pay, Aegon analysis shows it could leave you thousands of pounds worse off in retirement. What’s more, employees who pause pension contributions will very likely lose valuable employer contributions which help to boost retirement savings.”

|