Helen Morrissey, head of retirement analysis, Hargreaves Lansdown: “Managing an income drawdown pot throughout retirement can be challenging. We don’t know how long we are going to live and with recent data showing there are over one million people over the age of 90 and almost 15,000 centenarians in England and Wales the reality is it’s likely to be a multi-decade endeavour.

Understanding how much you can take to enjoy your retirement while making sure you don’t run out of money can be tricky with recent FCA Retirement Income Market data showing some unsettling trends. Well over 220,000 pots had an annual withdrawal rate of 8% in 2023/24 – well above the established rule of thumb which settles around the 4% mark.

Of course, there will be times when you need to take more money from your pension – for instance if you are planning a big overseas trip. However, if you are plundering your pot long term then you face the very real threat of running out of money.

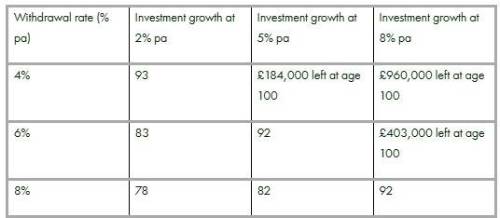

HL calculations show that a 65-year-old taking 8% from their £200,000 pension could find themselves with nothing by the age of 82. Amending that withdrawal rate to 6% would see it lasting longer - until around age 92. Sticking around the 4% mark would see you with £184,000 left by the age of 100. These are all based on investment growth of 5% per year but as we know investment markets can be volatile, and you could see periods of time where your investments grow at a higher or lower rate.

The optimal way to do it is to adopt a natural yield approach -this is where you take income determined by how your investments have performed. This means that you don’t eat into capital that could be needed later – for instance if you need to go into care. This will mean that the level of income you take will fluctuate so it can be a good idea to have a savings buffer to supplement your income during these times. We suggest having between one and three years of your essential expenses in an easy access account. It’s also really important that you invest in line with your risk appetite. For example, if you need income of 6% per year you need to be invested in assets that can deliver that kind of return.

Another option would be to adopt a mix and match approach to your retirement by using a mix of SIPP drawdown and annuities in your planning. You can annuitise in slices and make use of higher annuity rates as you age while keeping the rest of your pension invested where it has the potential to grow.

Recent data from HL’s annuity search engine shows a 65-year-old with a £100,000 pot can get up to £7,144 per year from a single life level annuity with a five-year guarantee. A 70-year-old could get up to £7,885 while someone annuitising at 75 would get over £9,100 per year. There’s also potential to boost your income further if you develop a health condition such as diabetes through an enhanced annuity. Securing levels of guaranteed income throughout retirement can give you peace of mind that you can meet your day-to-day expenses while leaving a portion of your pension to grow.”

Age at which a 65-year-old with a £200,000 pension pot would run out of money.

Calcs: HL Income Drawdown calculator.

|