|

|

After the Chancellor’s Mansion House speech in July, the DWP and regulators published a pack of pension policy papers. These come on top of the Private Member’s Bill paving the way to auto-enrolment enhancements as well as the ongoing challenging journey to turn pension dashboards into a reality. |

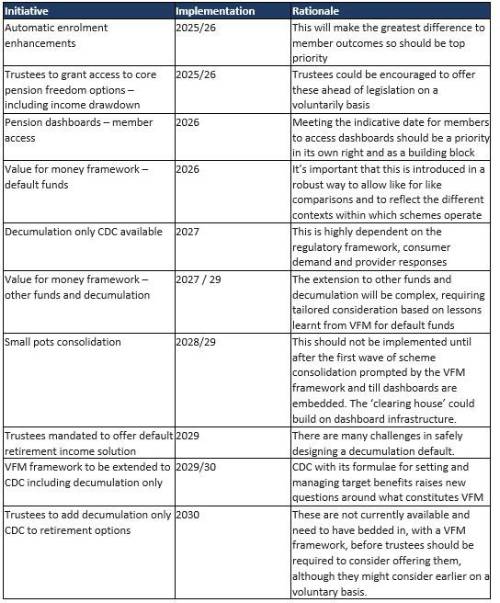

Aegon has suggested a roadmap to the UK Government which runs till 2030, encompassing not one but likely two future general elections.

Steven Cameron, Pensions Director at Aegon, comments: “The Government and regulators have gone into overdrive with a highly ambitious and radical pack of pension policy proposals. This covers enhancements to auto-enrolment, a new value for money framework, pension dashboards, wider retirement choices for trust-based scheme members, a solution for small deferred pension pots and extensions to the concept of Collective Defined Contribution schemes. With so many links and inter-dependencies, we need a ‘grand implementation plan’ which in light of the forthcoming general election would hopefully have support across political parties.

“This will include setting priorities, reflecting both a logical sequence but also importantly the size of potential improvements in member outcomes. The DWP’s own analysis1 shows that enhancements to auto-enrolment could improve member outcomes by more than all the other policy initiatives put together, making it a clear front-runner for prioritising.

“We urge Government to concurrently focus on the value for money framework, which is expected to lead to greater, faster scheme consolidation, and pension dashboards. These will both have particularly far-reaching benefits for many millions of members as well as being important building blocks to offering wider retirement choices for trust-based members as well as solutions to small deferred pension pots.

“In contrast, we’d recommend deferring any requirement for trustees to design default retirement income solutions until later in the decade, while any consideration of decumulation only CDC needs to factor in both the many outstanding questions here as well as the time industry will take to consider supplying these.” Aegon has recommended the following timetable to Government:  |

|

|

|

| Senior Pricing & Portfolio Management... | ||

| London - £150,000 Per Annum | ||

| Pricing Transformation Lead | ||

| London - £85,000 Per Annum | ||

| Lead Capital Actuary | ||

| London - £150,000 Per Annum | ||

| Take the lead on capital oversight | ||

| London / hybrid 2 days p/w office-based - Negotiable | ||

| Be at the forefront of creative GI co... | ||

| London/hybrid 2-3dpw office-based - Negotiable | ||

| Remote Market and Credit Risk Calibra... | ||

| Remote - Negotiable | ||

| Contact us about a Capital Contract i... | ||

| London / hybrid 2 days p/w office-based - Negotiable | ||

| Head of Insurance Risk | ||

| London - £160,000 Per Annum | ||

| Director - Pensions Risk Transfer (PRT) | ||

| London, Midlands, North West - hybrid working 2dpw in the office - Negotiable | ||

| Dip a toe into public sector work wit... | ||

| Flex / hybrid 2 days p/w office-based - Negotiable | ||

| P&C Consultant | ||

| London / hybrid 3dpw office-based - Negotiable | ||

| Take the lead client-facing projects ... | ||

| Various locations - Negotiable | ||

| Choose Life! Choose a major global co... | ||

| Various locations - Negotiable | ||

| Actuarial skillset? Apply now for Snr... | ||

| South East / hybrid with travel requirements - Negotiable | ||

| Financial Risk Leader - ALM Oversight | ||

| Flex / hybrid - Negotiable | ||

| Be the very model of a modern Capital... | ||

| London - Negotiable | ||

| Pensions Actuary seeking a high-impac... | ||

| London or Scotland / hybrid 3dpw office-based - Negotiable | ||

| Great opportunity for Pensions Actuar... | ||

| London or Scotland / hybrid 3dpw office-based - Negotiable | ||

| Responsible Investing Manager - Clima... | ||

| London/Hybrid - Negotiable | ||

| Quant Strategist | ||

| London/Hybrid - Negotiable | ||

Be the first to contribute to our definitive actuarial reference forum. Built by actuaries for actuaries.