Four-year pay squeeze returns public private differential to pre-recession

These are two headline findings from an in-depth analysis of this government's public pensions and pay policies done by IFS researchers in preparation for the launch of the annual IFS Green Budget on Wednesday 1 February.

The pension reforms just negotiated will make little or no difference to the long-term costs of public service pensions. The savings from higher pension ages are, on average, offset by other elements of the pensions becoming more generous. The current pay freeze and additional two years of one per cent increases will leave public pay at roughly the same level relative to private pay as it was in 2008.

A common element to both is the relative protection of lower earners - a group which tends to do better in terms of both pay and pensions in the public sector than in the private sector.

Pensions

Overall the proposed reforms improve the structure of public service pensions. But we predict that they will make little difference to the long-term cost of public pensions. By contrast the move from RPI to CPI indexation of public service pensions, introduced by this government in the October 2010 Spending Review, substantially reduces expected costs and generosity.

In general lower earners in the public sector will actually get a more generous pension as a result of the recently announced reforms. That is, they will be able to retire at age 65 with a higher annual pension than they would receive under current arrangements. This results from the move from final salary to career average schemes and the particular changes to accrual and indexation rules.

Conversely higher earners are likely to lose out. The move from final salary to career average relatively penalises those who see big increases in their earnings over time.

By increasing the generosity to lower earners - a group less likely to have a good employer pension in the private sector - the reforms increase the difference between the public and the private sectors.

Pay

Our analysis throws up three main conclusions:

First, it will take the whole of the two-year public pay freeze and two years of 1% pay increases to return public pay to where it was relative to private sector pay in 2008. This is because private sector pay reacted quickly to the recession. Pay in the public sector did not.

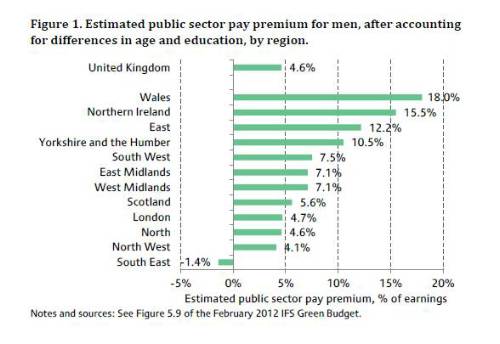

Second, there are big differences in estimated - that is after correcting for differences in age and education - public-private pay differentials between regions. For example, men in the public sector enjoy no pay premium in London or the South East of England, while in Wales the estimated premium is 18.0% (see Figure 1). But there is also tentative evidence that the premium varies across different occupations within the same region. For example, while male police officers appear to have the highest relative pay in Wales, for female primary school teachers the North West appears to have the highest relative pay, and for male paramedics the North East appears to be relatively the most generous.

Third, again after taking into account differences in age and education, the estimated public sector pay premium is greater for lower earners than it is for the higher earners, and there is no evidence that lower-paid public sector workers have fared relatively badly in recent years. The government's current policy of relatively protecting lower earners from the pay squeeze will increase differences between public and private sectors.

Carl Emmerson, Deputy Director of the IFS and co-author of the paper said "The reforms to public service pensions implemented by the last Labour Government, and this Government's decision to switch from RPI to CPI indexation of pension benefits, will in the long run reduce the generosity and therefore the cost of these schemes to the taxpayer. But the consequence of the long-drawn-out negotiations over the latest reform appears to be little or no long-term saving to the taxpayer or reduction in generosity, on average, of pensions for public service workers."

Wenchao Jin, a research economist at the IFS and co-author of the chapter said "There is evidence of considerable variation in the estimated public sector pay premium across the regions of the UK. This suggests that, on average, more generous pay awards in, for example, the South East and less generous pay awards in, for example, Wales and Northern Ireland might be appropriate. But the analysis also suggests that the regional pattern varies across public sector occupations. So while a shift to centrally-set, but regionally-varied, pay awards might be appropriate, these should be carefully implemented."

|