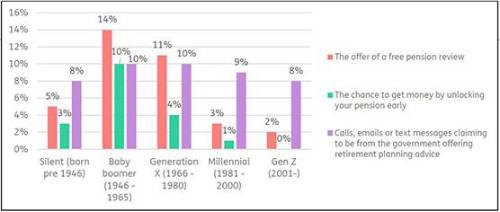

The regulator’s extensive Financial Lives report reveals that one in four (23%) 55-74 year olds received unsolicited approaches in the 12 months to October 20201. These mainly constituted offers of free pension reviews (14%), offers to ‘unlock’ pensions early (10%) or contact about retirement advice claiming to be from the government (10%).

The data shows this age group is being targeted far more frequently by scammers than all other generations.

Over 75s were around a third less likely to receive unsolicited approaches claiming to give them the chance to get money by ‘unlocking’ their pension early (3% vs 10%) and to receive offers of free pension reviews (5% vs 14%) compared to Baby Boomers.

Less than one in 20 (4%) Gen X’ers received approaches claiming to give them the opportunity to get money by unlocking their pension early.

FCA Financial Lives, Data Tables 2020, All other sections, 17.5 potential fraud and scams: https://www.fca.org.uk/financial-lives-survey/resources-library

Stephen Lowe, group communications director at Just Group, said that the figures highlighted the potential dangers that people reaching or within pension access age face.

“There is an epidemic of scam activity because fraudsters have worked out that the pensions of the Baby Boom generation are rich pickings and some unsuspecting savers are open to ideas about how best to take and use that money,” he said.

“Promising quick access to cash lump sums or high returns on investments is an easy way to get people’s attention – and ultimately their cash.”

He said that the FCA warns about free pension reviews which are often used to persuade people to invest in high charging, high risk schemes while accessing pensions early can trigger huge tax penalties. Those receiving cold calls about pensions should report those calls to the Information Commissioner’s Office.

“Unfortunately, many people are ill equipped to spot a scam having had little engagement with their pension over the years and the system isn’t helping them,” said Stephen Lowe.

The current approach to cracking down on scams has been criticised by the Work and Pensions Committee Chair, Stephen Timms, for being fragmented and too disparate and disconnected to be effective.

“The pension minster, Guy Opperman, has said he wants to see people using Pension Wise as ‘the norm’ and we strongly support this,” said Stephen Lowe. “It’s an obvious way to help protect savers from scammers given nearly all (95%) of customers who attended a Pension Wise appointment felt confident in their ability to avoid pension scams.”

Stephen Lowe said that the responsibility for designing a system in which it becomes ‘the norm’ for pension savers to use Pension Wise before accessing their pensions now sits with the FCA.

“Our research shows that a behaviour can only be considered a behavioural norm when about seven in 10 people are acting in that way which is a four or five-fold increase on current usage levels.”

“That’s an ambitious but achievable target for the FCA. It would be possible to transform numbers by taking the lessons of automatic enrolment into workplace pensions and applying it to Pension Wise by automatically booking appointments for people rather than expecting them to book sessions for themselves.”

“If the FCA wants to make a meaningful difference, its top priority should be to get people into Pension Wise appointments earlier rather than at the point of wanting to take cash when they have usually made up their minds,” said Stephen Lowe.

“One way to do that is to automatically book people onto appointments rather than leaving them to book the appointments themselves. The FCA is well aware of how inertia can be a force for good so we would like to see it pick up the challenge and prove it has the imagination and confidence to address the problem.”

|