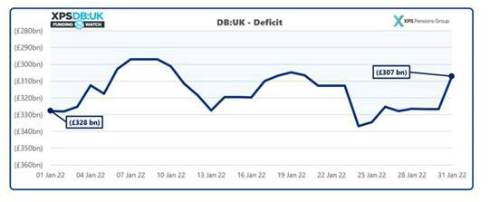

Deficits of UK pension schemes have decreased by c.£21bn over the month to 31 January 2022 against long-term funding targets, an analysis from XPS’s DB:UK funding tracker has revealed. Based on assets of £1,815bn and liabilities of £2,122bn, the average funding level of UK pension schemes on a long-term target basis was 86% as of 31 January 2022. XPS estimates that at the end of January 2022 the average pension scheme would need an additional £30,000 per member to ensure it can pay their pensions into the long-term.

Drivers of the change

The change in funding levels over January was small. Liabilities fell due to rises in gilt yields, partially offset by further rises in inflation, with assets falling according to the level of interest rate and inflation hedging in place. Whilst this move will have been beneficial for the funding level of unhedged pension schemes, falls in growth market assets have limited overall improvements in UK pension scheme funding levels over the month.

US Fed indicate rate rises

Comments made by the US Federal Reserve Chair Jay Powell on Wednesday 26 January strongly indicated that the Fed is planning to raise interest rates at their next meeting on 15-16 March. It will form part of the Fed’s efforts to curb inflationary pressures that are affecting the US economy, alongside the ending of its bond-buying programme. Traditionally, monetary policy tightening causes falls in growth markets, as it costs companies more to finance operations, and encourages consumers to look to save. Mr Powell did not rule out further increases throughout 2022, despite the Fed keeping all options on the table at this time.

The difficulty when tightening monetary policy is to ensure that economic growth can support rising borrowing costs; with US economy expanding by 5.7% over 20213, further rises are certainly possible if this growth is sustainable. January did represent the worst month for US equities since the beginning of the pandemic; the S&P 500 and the tech-heavy Nasdaq fell 5.3% and 9%, respectively, which would have been worse if not for a strong equity up-tick during the last couple of days of the month. It is unclear how much of the falls reflect investor sentiment on the monetary policy tightening; markets are already pricing in further increases in rates, indicating that such increases are generally considered inevitable as the global economy battles high inflation.

Potential Russia-Ukraine conflict

There are fears of potential military action in Ukraine; a possibility supported by the evacuation of some UK and US diplomats from Kiev. Alongside above concerns about monetary policy, the FTSE 100 fell by around 2.6% on 24 January 2022 as tensions escalated. European markets are understandably expected to suffer the most financially from any potential conflict, with the Euro Stoxx 50 falling by 4.1% on the same day.

A concern for European investors is the impact of any conflict on inflation. DB:UK has shown the significant impact over recent months that rising inflation has had on pension schemes, driven by supply chain difficulties and soaring energy prices. With European energy heavily dependent on Russian gas exports, any conflict could push up prices further; just one of the impacts that rising tensions may have on global markets.

Recalibration

This month DB:UK has been recalibrated to incorporate the latest industry data from TPR and the PPF. Whilst there is a small improvement to funding levels over the last year as result of rising gilt yields and positive asset returns, scheme deficits have remained at a similar level. Despite the improvement in position that most schemes will have seen TPR’s statistics2 show that whilst Recovery Plan lengths have reduced, they are still seeing an extension to the date at which schemes are anticipated to be fully funded. DB:UK estimates that it will take schemes 5 years longer to reach their long-term targets compared to this time last year, largely due to view that investment returns will be lower.

Charlotte Jones, Senior Consultant at XPS, said: ‘After a turbulent year, it’s one step forward and 5 steps back as a lot of schemes are finding themselves back where they started in early 2021 and their end-game even further out of reach. Whilst frustrating, trustees and sponsors must continue to work together to reach their goals, there are many ways they can get back on track whether it’s by exploring the options available to members, reviewing their investment strategies or by simply injecting more cash.’

|