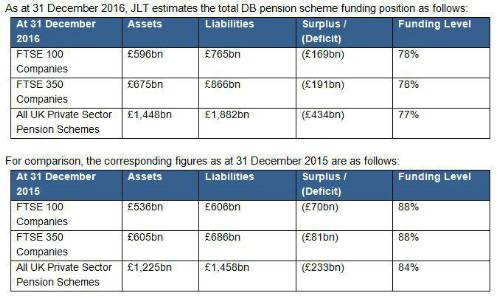

Charles Cowling, Director, JLT Employee Benefits, comments: “2016 has been a turbulent and tumultuous year not just for politics and markets, but also for pension schemes. This last month we have seen a slight deterioration in deficits but they are still below the record heights of over £500 billion recorded at the end of August, as markets rallied from Brexit and the US election shocks. However, pension scheme deficits are still significantly larger than the levels at the start of the year and there appears to be no relief in sight for companies with large pension schemes. Indeed, these figures represent a record year end deficit position for companies and their pension schemes.

“Now we have reached the all-important year-end for many companies, we are going to see many companies’ accounts showing a marked deterioration in their year-end pension numbers. There will be instances where the pension scheme will represent a serious threat to the company’s balance sheet and, in some cases, the company’s ability to pay dividends.

“Let us hope that 2017 brings some relief to hard-pressed pension schemes – and an easing of the burden of pension risks on employers, trustees and pension scheme members alike. We can hope that pension schemes will take further steps to manage both assets and liabilities and to reduce pension risks down to an affordable level. The tools now exist for an effective de-risking of pension assets and liabilities which, whilst not promising a silver bullet, do mean that pension problems can be managed and solved in time. Maybe 2017 will be the year when formal end-game de-risking strategies are at last embraced by the majority of pension schemes.”

|