Action Fraud estimates £30 million has been lost to scams from pensions since 20172, but the User Evaluations report from MaPS shows that taking a Pension Wise appointment has a significant impact on people’s confidence in avoiding scams.

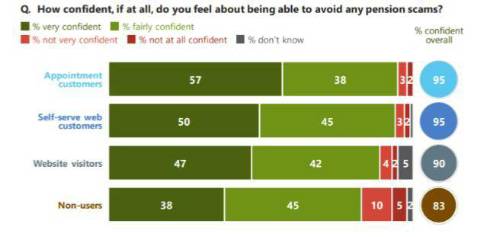

Nearly one in six (15%) of those who did not receive Pension Wise guidance are not confident they could avoid a scam attempt, compared to 95% of those who received a guidance session and then said they were confident they would be able to defeat scams.

This confidence is well-placed; Pension Wise also made users more knowledgeable about pensions in general, and therefore better equipped to avoid scams. On a series of factual true/false questions on pensions, Pension Wise users were right on 72% of their responses compared to just 46% from non-users.

Stephen Lowe, group communications director at Just Group said: The figures were a stark reminder of the urgent need for the FCA to actively increase take up of Pension Wise by introducing an opt-out system, similar to the highly successful and popular automatic enrolment scheme in place for workplace pensions.

“Pension Wise radically improves the confidence of its users in avoiding pension scams – a blight that ruins lives, causes immense mental anxiety and has seen tens of millions of pounds stolen since the introduction of pension freedoms.

“It is incumbent upon the FCA to introduce an active opt-out of the free, independent, and impartial guidance offered by Pension Wise. Doing so will make sure everyone benefits from Pension Wise guidance, creating a robust initial defence for consumers in the fight against scams.

“The current opt-in system is fundamentally flawed by a substantial gap in the awareness of Pension Wise – four in five DC pension savers aged 45-54 told us that they didn’t know it existed.

“If the regulator fails to act decisively and quickly, millions more people will miss out on guidance and will be left vulnerable to these pernicious scams the regulator says it wants to eradicate.”

|