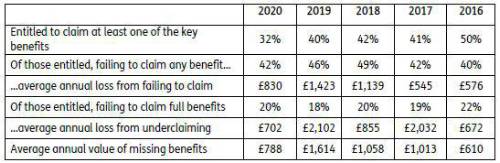

Just Group’s eleventh annual State Benefits insight report found that of pensioner homeowners entitled to receive benefits, four in 10 (42%) fail to claim with each household missing out on an average of £830 a year extra income, on average. A further two in 10 (20%) do claim but receive too little, on average missing out on £702 a year.

The research from Just Group, based on in-depth fact-finding interviews with clients seeking advice on equity release during 2020, shows about one-third (33%) were entitled to one or more benefits.

Interviews were carried out by specialist equity release advisers from Just’s sister company HUB Financial Solutions as part of the advice process to check if clients are eligible for State Benefits.

The highest amount of extra income lost was £4,854 a year by a customer in Durham who was failing to claim any benefit but was eligible for Council Tax Reduction and Guaranteed Pension Credit. In total, more than half of those eligible for more were missing out on at least £500 a year and a quarter missing £1,000 a year or more.

“Once again we have found meaningful sums that would make a massive difference to people’s lives are not being claimed,” said Stephen Lowe, group communications director at Just Group.

“It reflects the government’s own figures that show billions go unclaimed and raises serious questions about whether people in most need are able to navigate the complexities of the benefits system.

“Helping them to claim their full benefit entitlement reduces, and can even remove, the need to release equity at that time. This gives them extra income immediately and the peace of mind that leaving the maximum value tied up in their homes provides them with more flexibility to use that wealth for themselves later in retirement or to pass it on to loved ones.”

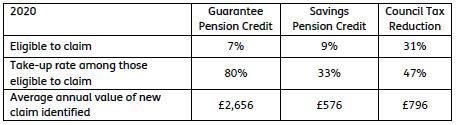

Breakdown of missed benefits

• Guarantee Pension Credit is the main benefit targeted at helping low-income pensioners. It has the highest take up rate of all the four key benefits with four out of five (80%) who are eligible claiming. But those failing to claim are missing out on an average £2,656 extra income per year, the most of all the benefits.

• Savings Pension Credit has the lowest take-up rate among State Pension-aged claimants, of just 33% of those who are eligible. Those failing to claim are missing out on £576 a year.

• Council Tax Reduction is claimed by less than half (47%) of those who are entitled to claim with an average shortfall of £796 a year.

“Our insight broadly reflects government figures which show that take-up of Guarantee Pension Credit is 70% and Savings Credit is 42% overall1,” said Stephen Lowe.

“For the two elements of Pension Credit, the government estimates up to a million households are failing to claim up to £1.8 billion or around £1,700 each. Couples are less likely to take up their entitlement than single people and the over-75s are less likely to claim than younger pensioners.”

He said the findings once again raise questions about the support and guidance available to those struggling for income, particularly among homeowners.

“Our research last year found that nearly half (48%) of homeowners aged over-65 had never checked their entitlement to State benefits compared to just one in seven (14%) who are renting2,” he said. “It reinforces the message that benefits information is integral to retirement guidance and that those struggling for income should check if they are missing out.”

There are a range of resources to provide information and guidance:

• The government highlights free, independent third-party benefit calculators at https://www.gov.uk/benefits-calculators

• Local councils provide information on financial help to pay rent or Council Tax

• Organisations such as the Money Advice Service and charities such as Citizens Advice and Age UK can be good sources of assistance.

• Professional advisers will charge but can provide regulated advice alongside information about benefit eligibility.

|