Prudential's Class of 2012 research highlights lack of long-term planning

Despite the on-going debate about the need to fund long-term care for the elderly, only one in five people planning to retire this year have made financial provision for ill-health in retirement, new research from Prudential shows.

Its ‘Class of 2012' study into the finances and expectations of those planning to retire this year shows that just 20 per cent have set money aside for any care needs. This drops to 16 per cent among those aged 65 plus.

Prudential's research also found that less than half (45 per cent) of this year's retirees have planned for the fact that they may need more income in retirement as they get older.

However, funding long-term care has never been more important. Although average life expectancy for men over the age of 65 is 17.6 years, and 20.2 years for women, healthy life expectancy is just 9.9 years for men and 11.5 years for women.

Vince Smith-Hughes, retirement expert at Prudential, said: "People retiring this year realise that living longer may mean they will need a higher income as they get older, but few of them have made the connection between the risk of ill-health, and needing money to pay for healthcare.

"Although life expectancy is increasing, healthy life expectancy is flat-lining. With the average person now working until they are aged 63.4, people are enjoying fewer healthy years in retirement.

"Spending the first few years of retirement trekking in the Andes and running around after grandchildren may be a reality for some, but it is important not to forget that health will worsen as pensioners get older.

"Making financial provision for the possibility of ill-health in retirement should be an integral part of the retirement planning process."

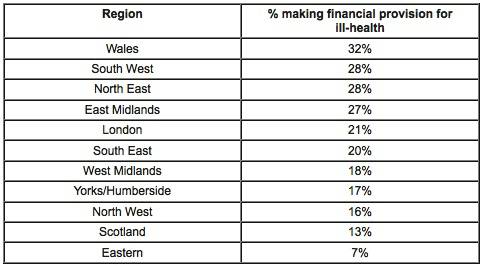

Across the country, those planning to retire this year in Wales are the most likely to have prepared for the risk of ill-health in retirement (32 per cent), while those in the East of England (7 per cent) are the least prepared.

The Government is currently considering recommendations from the Dilnot Commission on the Funding of Care and Support which, in July 2011, proposed that an individual's contribution to social care should be capped at £35,000, with any additional costs funded by the State.

|