Pensioners who have never checked whether they could claim State Benefits said their income and property wealth were the main reasons why they had never explored their eligibility according to advisory firm HUB Financial Solutions reveals.

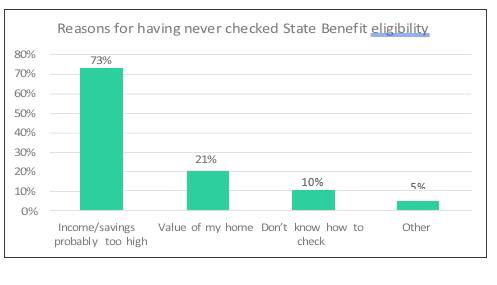

The research comes amid the persistently high cost of living and borrowing and found that nearly three- quarters (73%) of those who had never checked their eligibility for State Benefits did not because they thought their income or savings was too high to qualify for support.

More than a fifth (21%) have never checked because they believed the value of their property would make them ineligible, and one in 10 (10%) of respondents said they hadn’t checked because they didn’t know how.

“With billions of pounds of benefit income going unclaimed every year, it is vital that those struggling financially are not missing out because they wrongly assume they are not eligible,” said Simon Gray, Managing Director of HUB Financial Solutions.

“There is a huge range of resources for pensioners to help them check whether they could be entitled to receive additional State support. It is easy, free and could be worth substantial sums if they are able to claim some extra help.

“It’s worrying that one-in-10 said that they hadn’t checked because they didn’t know how – it shows we need to be proactive in educating, informing and helping retired households about how to access the support on offer.”

Among HUB Financial Solutions’ customers exploring equity release options in 2022, among those who were eligible for benefits, over six in 10 (62%) were failing to claim any benefit, with each household missing out on an average of £1,100 a year extra income.

A further one in four (24%) were claiming support but receiving less than their entitlement, on average missing out on £660 a year income.

“Every year our advisers find many homeowners, who are over the age of 55 and considering equity release, are missing out on benefits that they are eligible to claim,” said Simon Gray. “It indicates there may be a wider issue that people who own property are often under the mis-apprehension that they are not entitled to claim extra financial support from the government.

“Yet, official figures show that most retirees in the lowest income quintile own their own home and many of these people will have been hit hard by the current economic situation. This is particularly relevant given those not claiming Pension Credit face the double whammy of missing out on the additional targeted cost of living support.”

“We’d urge homeowners who are struggling for income to check whether they could be entitled to receive State Benefits – in a cost-of-living crisis, this support is worth its weight in gold.”

|