Cash-strapped pensioner homeowners are missing out on thousands of pounds of extra income by failing to claim their full entitlement to key means-tested State Benefits.

With the government focusing targeted financial support during the cost-of-living crisis on households receiving means-tested benefits, failing to claim could mean missing out on hundreds of pounds of additional tax-free payments in the coming months1.

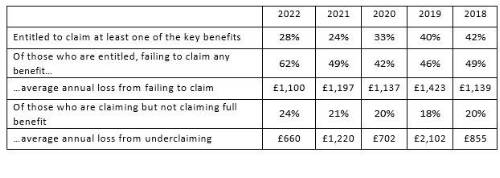

Just Group’s 13th annual State Benefits insight report found that of pensioner homeowners entitled to receive benefits, six in 10 (62%) were failing to claim any benefit with each household missing out on an average of £1,100 a year extra income. One in four (24%) were claiming but receiving less than their entitlement, on average missing out on an additional £660 a year income.

“Every year the figures consistently show the huge amounts of benefits that are going unclaimed but would make a massive difference to those struggling, especially with the added pressure of soaring living costs,” said Stephen Lowe, group communications director at the retirement specialist Just Group.

“This year the amounts unclaimed are down a little on recent years, but the proportion who aren’t getting their entitlements has risen. That’s particularly worrying because it means many could miss out on the extra tax-free Cost of Living Payments next year, worth up to £900, available for those claiming means-tested benefits.”

“About three in 10 households in our survey are eligible for one of the key benefits available to pensioners, but the majority are not claiming and those who are claiming often don’t get their full entitlement.”

The research from Just Group, is based on in-depth fact-finding interviews with clients seeking advice on equity release during 2022. It shows 28% were entitled to benefits. Of those, six in 10 (62%) were not claiming anything and nearly one in four (24%) were claiming too little:

“The first step carried out by specialist equity release advisers from our sister company HUB Financial Solutions is to check if clients are eligible for more income from the State,” said Stephen Lowe.

“Ensuring they claim their full benefits entitlement can give them extra income that will often reduce the amount they need to release or remove the need to release any funds altogether at that time.”

The highest amount of extra unclaimed income found was £79.76 a week for an octogenarian from Hertfordshire who was receiving no benefits. Advisers found he was eligible for £51.86 a week Pension Credit and £27.90 a week Council Tax Reduction – adding up to a huge £4,147 a year extra income.

In total, four in 10 (40%) of those missing out on income were entitled to benefits worth at least £1,000 a year.

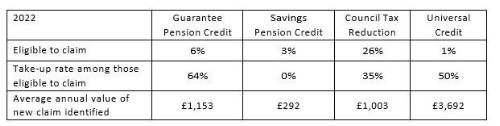

Guarantee Pension Credit is the main benefit targeted at helping low-income pensioners. It has the highest take up rate of all the four key benefits with two-thirds (64%) of those who are eligible claiming. But those failing to claim are missing out on an average £1,153 extra income per year.

Savings Pension Credit – a top-up for pensioners on low income who have modest savings – consistently has the lowest proportion eligible (3%) but also consistently low take up rates. For 2022 none of those eligible was receiving the benefit, losing out on £292 a year extra income.

Council Tax Reduction is the benefit with the highest eligibility but only one-third (35%) are claiming, missing out on an average of £1,003 a year.

Universal Credit - about one in seven of Just Group’s lifetime mortgage enquiries came from households below State Pension Age potentially eligible for Universal Credit. Although actual eligibility rates were low, the take-up rate was just 50% with £3,692 a year annual income being missed.

Overall, 62% of those eligible to claim were missing just one of the key pensioner benefits and 9% were missing out on two benefits.

Latest official figures show that take-up of Guarantee Pension Credit is 73% and Savings Credit 43% overall in 2019/202. Government estimates suggest 850,000 families entitled to receive Pension Credit did not claim, totalling about £1.7 billion or around £1,900 a year.

“The reason our take-up figures are a little worse could be that homeowners struggling on low incomes may think the value of their home rules them out of State support,” said Stephen Lowe. “Our own research in 2021 found 44% of homeowners aged 65+ had never checked their entitlement to benefits compared to 16% of renters3.

He said the findings once again raise questions about the support and guidance available to people head into retirement and beyond.

“Benefits information is integral to retirement guidance and messages that a range of benefits are available to help people who later in life are in poor health or find themselves struggling for income should be reinforced during any guidance provided.”

There are a range of resources to provide information and guidance:

• The government highlights free, independent third-party benefit calculators at https://www.gov.uk/benefits-calculators

• Local councils provide information on financial help to pay rent or Council Tax

• Organisations such as the MoneyHelper and charities such as Citizens Advice and Age UK can be good sources of assistance.

• Free, impartial and independent guidance is available to retirees through the government- backed Pension Wise.

• Professional advisers will charge but can provide regulated advice alongside information about benefit eligibility.

|