Failings of the pension system over the years have led to calls for more legislation and regulation, to prevent scandals being repeated. While rules might indeed be a good thing, too many might be bad for us. The vast number of rules has led to an over-complicated pensions system that leaves not only the public bemused by the whole subject, but also the professionals.

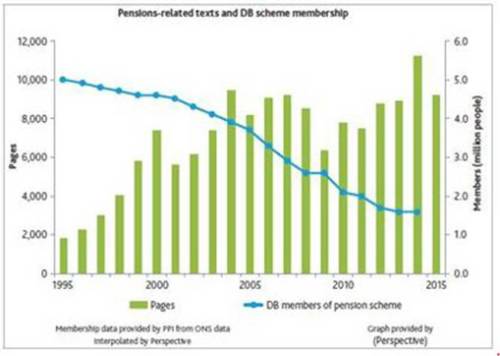

Despite the major increase in pensions rules over the last ten years, aimed at protecting the consumer and encouraging better retirement saving, there has been a significant drop in the membership of defined-benefit pension schemes (see graph below), with many people on course for inadequate incomes in retirement.

Widespread discontent, general confusion and concern that the forthcoming Government Green Paper on defined benefit schemes will recommend yet more legislation has led to this review of the legislative and regulatory state of pensions in the UK.

Jointly prepared by international law firm Pinsent Masons, in collaboration with Pendragon, the publisher of Perspective, the electronic industry standard compendium of pensions regulation, and The Pensions Institute, the Cass Business School research body, the review has prompted a number of preliminary conclusions, including:

• that it might be a better environment for pensions were government to issue a holistic statement of its pensions policies;

• that any additional regulation or legislation should be evidence-based;

• that there should then be a deregulation exercise for all pensions regulation and

• that there should be a consolidation exercise, so that there would be a legal pensions code, understandable by the majority of those concerned.

Carolyn Saunders, Head of Pensions and Long-Term Savings at Pinsent Masons, says: "The present system is considered by most to be dysfunctional, leading to confusion, expense and a reduction in provision by employers. Whilst auto-enrolment is making some headway, for most of the population there is a reduction in the amount being set aside for retirement at a time when the population is aging and the savings ratios should be higher. Regulation may not be the sole reason for the decline, but it seems to be a major contributory factor.''

The diagnosis of excessive regulation has been accepted by government in areas other than pensions. For example, it has adopted: a Red Tape Challenge programme; and a OITO ('one in two out'; now 'one in three out') policy which requires departments putting forward new regulations to remove three existing ones. These, amongst others, are dedicated to rolling back excesses in rule-making. Yet this deregulatory policy has not been extended to pensions.

To download the full review on the state of pensions regulation in 2017, click Pensions and Chocolate the state of pensions regulation 2017

|