By Martin Palmer, FriendsLife

Predictably, with the increase in the state pension age and auto enrolment on everyone’s lips at the moment, reaction to the Pensions Bill was explored. As we know, women were already seeing their pension age rise from 60 to 65, so plans to accelerate these changes, and implement them in 2018 – two years earlier than previously agreed - mean many women will have to work 2 years longer than they had expected. The move will enable the pensions age for both sexes to be increased to 66 by 2020.

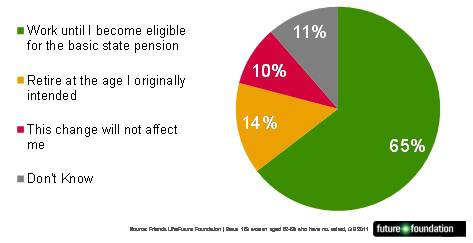

The Visions of Britain research revealed that 65% of women affected by the proposed changes in the Pensions Bill said they would not be able to retire early, and would have to carry on working until they became eligible for the state pension. Hardly surprising, given the tough economic climate at the moment. And 68% of working women (compared to 62% of men) accepted that they will actually have to work beyond the date at which they can take their State pension in order to fund their retirement.

"The basic state pension age is gradually increasing for women to 66. The government has recently oulined plans to speed up this increase from 2016...Which of the following will you do as a result of this change".

This could be down to a number of factors including the reality that, on the whole, women earn less than men and so therefore need to work for longer to ensure financial security in their retirement. What the Visions of Britain research also shows is that the age at which people start to think about saving for a pension varies between men and women, which could also be a reason behind the disparity. Among those who are in employment, women are much more likely to start saving later in their lives than working men. Only 7% of working men who are saving for a pension started to do so after the age of 35; compared with 18% of working women.

For years many women didn’t pay into pension plans, relying instead on their husband’s pensions. This was always an extremely high-risk strategy and it is a relief to see that things are shifting: nowadays two thirds (67%) of working women are saving for a pension themselves. Just over half (51%) have an occupational pension; 11% have a personal pension. This number did not increase drastically when a partner’s pension was taken into consideration.

The fact that women are no longer relying on men to provide a pension is clearly a positive thing for our industry as our reach expands wider but, more importantly, it is important for society as a whole that women are becoming more financially independent. We all know that the tradition in days gone by was that the man of the house would be the breadwinner and family provider, so it would naturally fall on them to provide financial security into retirement. Society is now very different and women’s increased financial independence means that more and more are now focusing on their own financial needs into retirement.

Childbirth, marriage, divorce and widowhood all have significant impacts on pension growth for the majority of women. Childbirth - and maternity leave in particular - is often viewed as something that stunts career growth for women as well, and many are anxious about losing their job security while they are not at work. Moreover, those who do retain their jobs and come back to work naturally have to work hard to catch up on what they have missed.

We must, of course, also accept that in the current economic climate many people are almost entirely focused on their more immediate needs, with spiralling fuel and food bills combined with uncertainty over jobs potentially leading to a short-term culture financially. While this is entirely understandable, we also know that the need to provide financially for retirement remains a pressing one.

This research plays an important role in keeping the issue at the front of people’s minds as well as highlighting what changes have already occurred for working women today. The findings are positive for the pensions industry, as we now see that society as a whole is looking to the future and making the necessary arrangements to ensure a financially secure retirement, regardless of their gender.

|