By Fiona Tait, Technical Director, Intelligent Pensions

Arguably many of the key components of the dashboard are available already, if you know where to look. People can find their lost pensions through the Pension Tracing Service and obtain valuations and projections via the State Pensions Forecaster and their annual pension statements. The problem is most people don’t know where to look, and even if they did the quality of the information they receive is extremely variable in both content and format. The point of the dashboard was to bring it all together in one place, in a consistent and easy to understand format which everyone would be able to find without looking too hard.

It would certainly be possible for the industry to build the dashboard without the DWP as Esther McVey has apparently suggested, however the result would not be as good. Here’s why.

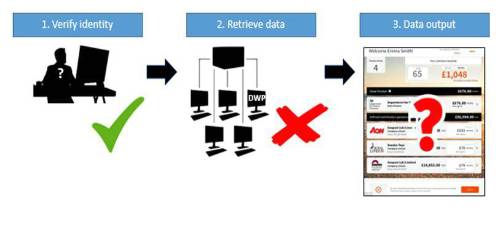

The dashboard will comprise of 3 main components, each of which would benefit from government support:

1. A portal which allows individuals to access their data

2. Data interfaces with pension providers and scheme administrators

3. Accurate and real time data output which consumers can rely on.

Verifying identity

This is vital because as much as we need people to be able to access their own data, we also need to be able to protect that data against access by the unscrupulous. The government Gateway service is a trusted portal which many people are already familiar with. Using the cross-sector equivalent Verify service should inspire more confidence and make people more likely to actually use the dashboard.

Data access

One of the stated aims of the dashboard is to help people find lost pensions. If the industry is left to build the dashboard those who can already provide the required data will sign up, but these are the ones which are least likely to be lost. It is vital therefore that pressure is brought to bear on those schemes and providers who won’t participate on a voluntary basis. As there are estimated to be over 60 million pension pots in existence in the UK this will require at the least strong regulatory intervention, and most likely legislative enforcement.

Another obvious issue is the State Pension, which is run by the DWP. For many older people the State Pension provides the principle element of their income and it must therefore be integrated into the dashboard if it is to provide a realistic picture of retirement.

Consistent data output

The final issue is the content and quality of data provided. The prototype project team has already delivered a suggested format, however it is not based on real information. When this becomes available it must not only be accurate, it must be provided on a consistent basis. The prototype format looks good but unless it is prescribed, particularly with regard to benefit projections, some pension schemes will find it easier to continue with their current practice rather than conforming. Furthermore this format needs to be agreed sooner rather than later to allow providers and schemes to design their data outputs.

A consistent, and approved, format could be achieved by the regulator on its own but it would benefit considerably from government support.

The DWP also needs to consider whether there should be a single dashboard available via the gov.uk website, or whether it will allow multiple dashboards hosted by a variety of commercial organisations. Consumer research suggests a strong preference for a single entity, although it might be accessed via alternative sources. If the government does not want to host this, it must decide who should, and who will pay for its development. Hopefully the long-awaited feasibility study will confirm which of these methods will be trialled and by whom.

In conclusion

The pension dashboard benefits everyone. First and foremost savers will be able to keep track of all their savings and monitor progress towards realistic retirement goals. Providers will maintain contact with more of their customers and advisers will be able to obtain more information from their clients quickly and without fuss. The government will benefit in the long run as people recognise the need to take responsibility for their own future in retirement.

So while Ms McVey’s willingness to “back the pension industry” to deliver the dashboard is all very nice, with the best will in the world (and that is not a given) it will be a huge disappointment if this is all we’re going to get.

|