The firm says that people with defined contribution pension savings below £1 million could stop making contributions or invest more conservatively to avoid a tax charge; as people with large pension pots approach retirement, the tax system will give them an incentive to take their tax-free lump sum and put the rest of the money into drawdown rather than leave their savings untouched. Towers Watson also warns individuals who might be affected to think twice before giving up valuable employer-financed pensions for the sake of avoiding a Lifetime Allowance Charge.

The Chancellor announced that the Lifetime Allowance will fall from £1.25 million to £1 million in April 2016. A 55% tax charge applies to excess pension savings above this value when people draw their benefits (compared to their marginal rate of income tax at the time, typically 40%):

-

For someone using a defined contribution pension pot to buy an index-linked annuity with a spouse’s pension, this cuts the maximum annual income within the Lifetime Allowance from around £33,500 to just under £27,000 (before taking tax-free cash).

-

For people in defined benefit schemes, the maximum annual pension is reduced from £62,500 to £50,000.

Jackie Holmes, a senior consultant at Towers Watson, said:

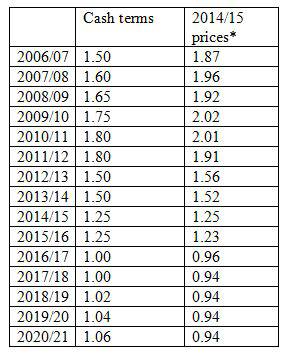

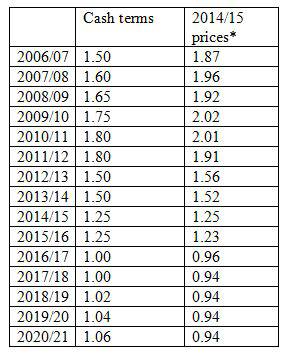

“In cash terms, the Lifetime Allowance has been reduced from £1.8 million in 2010 to £1 million in 2016. Once you take account of inflation, its real value will have more than halved. As with previous cuts to the Lifetime Allowance, people who already have pension pots worth more than £1 million will be protected – but for higher earners who haven’t already done their pension saving, it will be too late.”

As George Osborne said in 2004: “if a pension pot is invested in shares that do very well, a person can be taken over their lifetime allowance thanks to their own good investment decisions. There is a curious and perverse incentive in the very concept of a lifetime allowance.”**

Jackie Holmes said: “A lower Lifetime Allowance will force more people to guess whether investment returns could take them above £1 million when weighing up the case for adding to their pension savings. Even with the welcome news that the Lifetime Allowance will be indexed from 2018, someone who has £705,000 in a pension pot now could expect to hit the Lifetime Allowance if they achieve nominal investment returns of 5% a year before retiring in 10 years’ time, so it’s not just people with seven-figure pension pots who could stop saving now. Wealthier pension savers may also be less prepared to risk losing money in pursuit of higher returns if any upside has to be shared with the Government while any loss is all theirs.

“This change will also encourage wealthier savers to access their pensions sooner. Savings are tested against the Lifetime Allowance at the time benefits are accessed. Someone with pension savings at the level of the Lifetime Allowance should therefore be better off taking their 25% tax-free lump sum and putting the rest into drawdown; if they leave it untouched, investment growth could take them over the limit. This is especially the case now that there is no tax advantage in still having ‘uncrystallised’ pension savings if you die before 75. Any remaining drawdown funds will be tested against the Lifetime Allowance again at age 75 but there will only be a tax penalty if the value has grown above £1 million.

“The 55% Lifetime Allowance charge is punitive but sometimes it is better just to pay the tax than to give up valuable benefits that come with a tax bill attached. Some employers offer cash alternatives to pensions for people who have already reached the Lifetime Allowance, but for people in defined benefit schemes these rarely get close to the value of the pension that must be given up. If your employer isn’t offering a cash alternative at all, it’s better to pay 55% tax on something than 0% tax on nothing – though the decision is less straightforward if the employee must contribute to benefit from what the employer is putting in.”

|