Key points:

61% of workers under 40 would open a LISA and over two thirds (68%) of them would save into a LISA alongside a pension

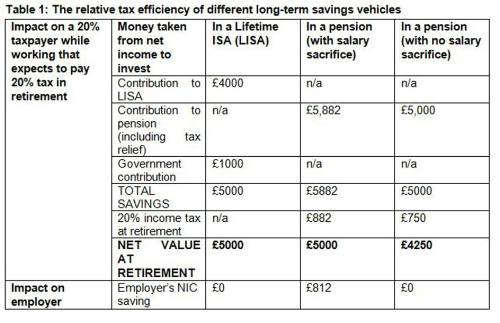

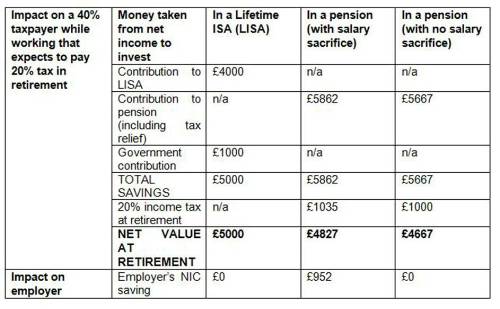

Whether a LISA or pension is a more tax efficient savings vehicle will depend on your tax status [see table below]

Pension saving is still generally the best long-term savings option for both basic and higher rate tax 40% taxpayers

Pension saving that attracts an employer matching contribution remains the best option for all. This includes auto-enrolment schemes

Everyone under 40 should open a LISA to provide increased savings flexibility through to age 50

Only a handful of providers have products ready for launch but as demand is proved, others will follow

Commenting, Paul Waters, Partner at Hymans Robertson, said: There’s real appetite from those under the age of 40 to invest in a LISA. 61% said they’d open one of these new accounts, according to research1 we’ve undertaken. But encouragingly people still recognise the benefits of pensions. Over two thirds (68%) said they’d save into both a LISA and a pension at the same time. This is good news as we need to move away from looking at pensions and LISAs as competing products. One should not be at the expense of the other.

“While people view LISAs as a product that could help long term savings, they still clearly appreciate the benefits of pensions, particularly the extra boost they get from employer contributions. This is supported by the fact that most who would open a LISA would still save more to their pension (49% would save more to a pension and 19% more to a LISA).”

Paul Waters commenting on the importance of prioritising pensions over LISAs for retirement purposes, said: Those who considering ditching pension savings in favour of a LISA will need to consider what they are looking for in their long term savings. It will be important to assess the differences between a LISA and a pension, especially in terms of tax efficiency. The right choice will depend on whether they need flexibility (cited as attractive by 36%), the incentives available to them, such as the LISA government top up, and the level of income tax they pay.

“If you’re absolute goal is retirement saving, a pension is generally your best option. Pensions come with strong incentives to save, in the form of upfront tax relief and employer matching contributions for many in the workplace. For higher rate tax payers the tax relief is better than that available in a LISA. But for any young, very high earners who have reached pension annual or lifetime allowance limits a LISA is a good option. Most basic rate tax payers will benefit from extra contributions from their employer in pension, as well as lower charges – although if they don’t then a LISA works for them”

“However many people out there will have other important priorities out there like saving for a house. Anything that gets people into the saving habit early on should be a good thing. Employers have a role to play here and can integrate LISAs into their benefit provision, with some giving flexibility over employer funding to allow employees to choose between pension and LISA based on their personal circumstances.

“There is complexity and people need support and guidance to make the right decisions for them to avoid making the wrong choices. Our research found that there is still a minority (18%) who said they would redirect savings to a LISA. Employers have a role to play here. Being on the front foot and integrating the LISA in the workplace would allow employers to guide and inform their staff’s decision making.”

Hymans Robertson analysed who would benefit from investing in LISAs compared to pensions in a range of scenarios. [See table 1 below]

Commenting on the provision of LISA products, Karen Brolly, Head of Life and Financial Services Products, Hymans Robertson says: For a while, only Hargreaves Lansdown was set to offer a product at launch, but we’ve seen a number of other providers enter the market including Skipton Building Society, Scottish Friendly, The Share Centre, One Family and Nutmeg. Given the demand for LISAs, it’s not surprising more have entered the market. There is also good reason to expect that those insurers offering products early will be in a good position to become market leaders, as LISA money will probably prove to be ‘sticky’. In fact, we’re surprised more providers aren’t in the market, but we may see more enter over the coming months.”

|