The report also highlights the huge complexity which has been created by repeated changes in tax limits, with around 100,000 people now covered by complex transitional protections associated with the different reductions in lifetime limits.

The paper, Pensions Tax Relief: ‘Time to end the Salami Slicing’, looks at the way that cuts in the Lifetime Allowance (LTA) for pension tax relief have interacted with falling annuity rates to reduce the size of pension that can be bought within HMRC limits. The LTA was cut in 2012, 2014 and 2016, from a peak of £1.8 million to just £1 million now, whilst annuity rates have fallen by around one third in the last decade. Although only a minority of people currently have pension pots at this level, if the limit is held constant in real terms (which is the government’s current policy), this limit will affect more and more savers and not just the highest earners.

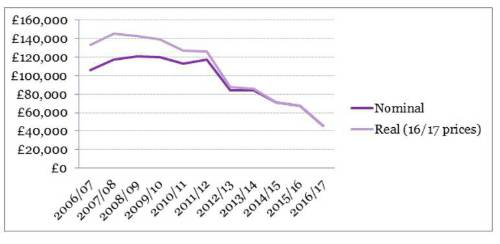

Royal London calculates that in 2016/17, with an annuity rate of 4.54%, a £1 million pot would buy an annual pension of just £45,400, whereas in 2007/08, an annuity rate of 7.36% applied to the LTA would have generated a pension of £117,760. Taking account of inflation since 2007/08, this represents a real terms cut of over two thirds.

The graph shows the level of annual income which could be bought with a Defined Contribution pension pot equal to the lifetime allowance from 2006/07 to 2016/17 a) in cash terms and b) in 2016/17 prices:

For those looking to use their pot to buy a pension with inflation protection and something for a surviving spouse, the situation is far worse. A £1 million pension pot would buy a pension starting at just £27,100 if it rose by 3% a year and provided a 50% survivor’s pension, whilst the starting pension would be just £20,860 if the pension was fully linked to the Retail Prices Index and provided a two thirds survivors pension.

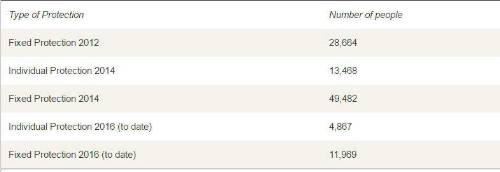

Each time the Lifetime Allowance is reduced, HMRC allows individuals to apply for complex forms of transitional protection, and it is estimated that the numbers covered have now reached around 100,000 as shown in the Table:

Applications for Fixed and Individual Protection against increases in the Lifetime Allowance

Each of these forms of transitional protection has its own complex system of rules and adds further to the cost to individuals and to the taxpayer of administering the system. In addition to the complications around the Lifetime Allowance, the report notes that the new tapering system on the Annual Allowance for higher earners has added yet more complexity to the system.

Commenting on the results of this analysis, Royal London’s Director of Policy, Steve Webb said: “The limits on tax relief on pension contributions have faced a series of cuts over the last decade. Each one on its own may seem like no more than ‘salami-slicing’. But the cumulative impact of the cuts, compounded by the fall in annuity rates, means that the pension you can buy whilst staying within HMRC limits has fallen by two thirds in just a decade. With each cut the system has become more and more complex, and many tens of thousands of people are now actively trying to avoid saving too much into a pension. The salami-slicing has to stop. The best thing the Chancellor could do in the Autumn Statement would be to announce that he is leaving pension tax limits unchanged for the rest of this Parliament. Saving for a pension should be a long-term business, and constant tinkering with tax limits in pursuit of short-term revenue gains creates uncertainty for savers and makes saving in a pension a less attractive option.

|